Paying off debt is a crucial step toward achieving financial stability and independence. However, the path to debt freedom can often be riddled with challenges, especially when common mistakes are made. These missteps can slow progress, increase stress, and even lead to more financial burdens in the long run. By identifying and addressing these errors, anyone can create a more effective and manageable plan to eliminate debt for good. This article highlights the top mistakes people make when paying off debt and provides actionable strategies to avoid them, ensuring a smoother and more successful journey to financial freedom.

Ignoring a Budget

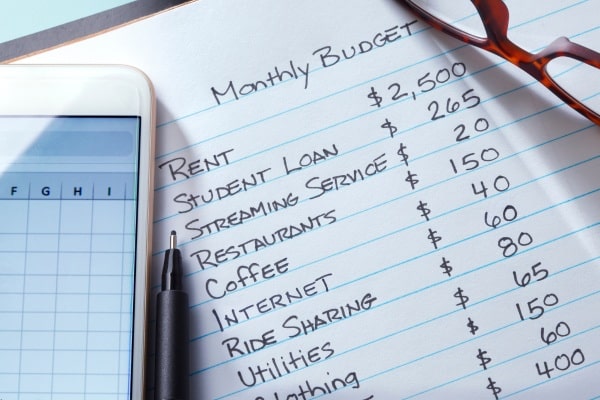

One of the most common mistakes people make when tackling debt is neglecting to create and follow a budget. Without a clear understanding of where money is going, it’s easy to overspend on non-essentials, leaving little left to allocate toward debt repayment. A budget acts as a roadmap, ensuring that every dollar has a purpose and is used effectively. Without it, financial progress often stalls, and debt remains stagnant.

Building a realistic budget tailored to individual circumstances is essential. Start by tracking all income and expenses to see where adjustments can be made. This process helps identify unnecessary expenditures that can be redirected toward debt payments. Budgeting tools or apps can simplify this task, making it easier to stick to the plan and remain consistent. Over time, a well-maintained budget can lead to greater financial control and faster debt repayment.

Paying Only the Minimum Amount

Making only the minimum payment on debts is a costly mistake that keeps individuals trapped in a cycle of interest and prolonged repayment. Minimum payments are designed to favor lenders, ensuring that the bulk of the payment goes toward interest rather than the principal. This practice makes debt repayment feel endless and significantly increases the total amount paid over time.

Increasing monthly payments, even by a small amount, can drastically shorten the repayment period. For example, adding just an extra $50 to a credit card payment each month can save hundreds or even thousands of dollars in interest. Prioritizing higher payments demonstrates a commitment to debt elimination and accelerates progress. Setting up automatic payments can also ensure consistency, helping individuals stay on track without the risk of missed or late payments.

Taking on New Debt While Repaying Old Debt

Many people undermine their debt repayment efforts by continuing to take on new debt. Whether it’s opening a new credit card, financing a large purchase, or taking out a personal loan, this behavior increases financial strain and offsets progress. Adding new debt often means juggling multiple payments, which can quickly become overwhelming.

Avoiding new debt requires discipline and strategic planning. Consider freezing credit cards or switching to a cash-only system to prevent unnecessary spending. It’s also important to evaluate whether a purchase is truly necessary or if it can wait until the current debt is resolved. By staying focused on the ultimate goal of debt freedom, individuals can resist the temptation to borrow more and instead allocate their resources toward paying off what they already owe.