Raising financially savvy kids is crucial in today’s complex economic environment. By instilling sound financial habits early on, children can develop the acumen needed to navigate their future with confidence. This comprehensive guide provides parents with family finance tips to teach their kids the value of money, smart spending, and saving. The ultimate goal is to prepare the younger generation for financial independence and success, contributing to a lifetime of wise financial decisions.

Contents

Understanding Money: The Basics

Explaining the concept of money to kids lays the foundation for their financial literacy. Start by demystifying the different forms of currency, from coins to digital payments, and the roles they play in everyday transactions. Engage them in simple activities like setting up a piggy bank, which visually demonstrates how money accumulates over time. Reinforcing these basic principles can pique a child’s interest in financial matters and encourage a mindset geared towards saving rather than immediate gratification.

Incorporating financial terminology into daily conversations can also help children grasp basic economic principles. This could involve explaining budgeting during grocery shopping or discussing the cost of living during family meals. Through consistent exposure to these concepts, children can learn to appreciate the value of money and the importance of managing it responsibly, setting the stage for more advanced financial lessons in the future.

Earn, Save, Spend: Teaching Through Allowance

Allowances serve as one of the first opportunities for children to manage money independently. By earning an allowance through chores or tasks, they begin to understand the relationship between work and income. This hands-on experience teaches the fundamentals of earning and encourages children to think critically about how they choose to use their money, whether it’s saving for a new toy or spending on a treat.

Encouraging children to save a portion of their allowance can instill the habit of saving from a young age. Parents can help by setting up a savings jar or account where children can watch their money grow. Additionally, discussing the impact of impulsive purchases versus thoughtful spending can guide them towards making informed decisions. This practice not only teaches the value of money but also introduces the concept of delayed gratification, a key component of financial discipline.

Setting Financial Goals: The Family Approach

Families that set financial goals together create a culture of accountability and mutual support. Initiating conversations about financial aspirations, whether it’s saving for a vacation or a new family computer, can help children understand the planning and effort involved in achieving such objectives. By participating in these discussions, children learn the significance of setting and working towards goals, which is an essential skill in financial planning.

To make these goals more tangible, families can create visual representations like charts or trackers that allow children to see progress. Celebrating small milestones along the way reinforces their contribution and the satisfaction of reaching a target. This inclusive approach not only makes financial goal-setting a shared venture but also introduces children to the concept of budgeting for specific objectives, a practice that will serve them well in all financial endeavors.

The Value Of Money: Smart Shopping And Consumer Awareness

Teaching children about smart shopping begins with understanding that money has limits and must be spent wisely. It’s beneficial to involve them in price comparison exercises, demonstrating how to get the best value for money. This can be done during regular shopping trips or through online research, showing them how prices vary between brands and stores. By learning to discern between wants and needs, children can make more informed decisions about their purchases, appreciating the worth of items relative to their cost.

Consumer awareness is another critical aspect of financial literacy. Children should be aware of how advertising influences spending. Discussing the persuasive tactics used in commercials and ads can equip them with the skills to resist impulsive buying triggered by marketing. This level of awareness helps children to question the necessity of purchases, fostering a more critical approach to consumerism. It also prepares them to make autonomous and reasoned decisions about spending as they grow older.

Digital Money Management: Apps And Online Tools

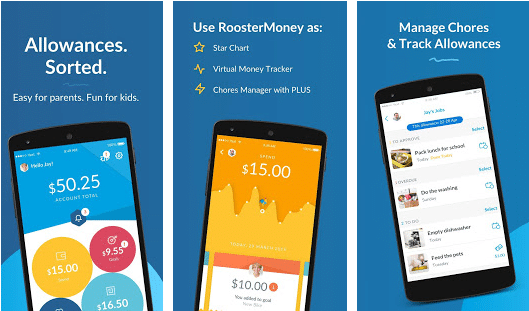

The digital world offers a plethora of tools to aid in teaching money management. Introducing children to financial apps that track spending, savings, and even investing can make managing money engaging and interactive. These digital platforms often use gamification to teach financial concepts, which can be particularly effective with the tech-savvy younger generation. Parents should guide their children through these apps, ensuring they understand the features and the importance of security in digital financial transactions.

Online banking and savings platforms can also provide a practical framework for children to learn about managing finances digitally. With parental oversight, children can observe how money can be moved and managed through clicks and swipes, which demystifies banking and can reinforce lessons in digital financial literacy. It’s crucial to stress the importance of privacy and the risks involved with online financial activities, to ensure they adopt safe practices from the start.

Financial Planning For The Future: Education And Investments

Engaging children in planning for future expenses can be both educational and empowering. Discussing the costs associated with higher education can be an eye-opener for many children, prompting them to think about saving for the future. It can also be the impetus for discussions about scholarships, grants, and other forms of financial aid. Such conversations can motivate children to take an active role in their educational journey and understand the financial commitments that come with it.

An introduction to simple investment concepts can also be beneficial. Savings bonds or shares in family-friendly companies can serve as practical examples of how money can grow over time. Parents can explain the principles of risk and return, and why some people choose to invest their money rather than keeping it in a savings account. This early exposure to the idea of investments can lay the groundwork for more sophisticated financial education as they mature.

The Bottom Line

Equipping children with the tools and knowledge to make sound financial decisions is an invaluable investment in their future. Through practical lessons in earning, saving, and spending, as well as strategic planning and charitable giving, children can develop a robust financial literacy. The journey towards financial savvy is continuous and ever-evolving, with each step building upon the last, ensuring that today’s young learners become tomorrow’s financially astute adults.