Navigating the financial landscape as self-employed comes with unique challenges and opportunities. Unlike traditional employment, self-employed professionals must tackle irregular income streams, tax planning, retirement savings, and more without the safety net of employer-sponsored programs. This article delves into strategic financial practices essential for the self-employed, aiming to provide a financial stability and growth roadmap. From setting up a solid financial foundation to leveraging technology for financial management, the guidance offered here empowers self-employed professionals to make smart money moves, ensuring long-term success in their entrepreneurial journeys.

Contents

- Setting Up a Solid Financial Foundation

- Emergency Funds and Insurance: Safeguarding Your Financial Future

- Smart Tax Planning: Maximizing Savings and Compliance

- Retirement Planning: Investing in Your Future

- Debt Management and Credit: Balancing Growth and Risk

- Expanding Your Income Streams: Diversification and Growth

- Leveraging Technology for Financial Management

- Final Thoughts

Setting Up a Solid Financial Foundation

The cornerstone of financial security for the self-employed is establishing a solid foundation, which begins with the separation of personal and business finances. This segregation simplifies accounting processes, aids in accurate tax preparation, and enhances financial clarity. Self-employed individuals must manage financial management with the discipline of a traditional business, utilizing separate banking accounts and credit cards designated solely for business transactions.

Another pivotal step is creating a comprehensive budget. Due to the variable nature of self-employment income, a detailed budget must account for both regular expenses and irregular income patterns, ensuring that savings targets are met and that there’s a cushion for leaner times. This budget should be revisited and adjusted regularly to reflect actual income and expenses, keeping financial goals in sight and achievable.

Emergency Funds and Insurance: Safeguarding Your Financial Future

An emergency fund is an indispensable safety net for the self-employed. It is designed to bridge the gap during periods of reduced income or unexpected expenses. Financial experts often recommend setting aside enough to cover at least six months of living and business expenses. This target underscores the importance of liquidity for those without a predictable paycheck.

Insurance is equally critical in safeguarding one’s financial future. Health, disability, and business insurance policies protect against significant financial losses due to illness, injury, or business interruptions. Choosing the right insurance coverage requires a thorough assessment of risks and coverage needs, emphasizing the importance of preparedness in facing life’s uncertainties.

Smart Tax Planning: Maximizing Savings and Compliance

Mastering tax obligations is both a challenge and an opportunity for the self-employed. Proper tax planning involves understanding the nuances of self-employment taxes, leveraging deductions, and keeping meticulous records of all income and expenses. This proactive approach ensures compliance and can significantly lower tax liabilities, allowing more income to be reinvested into the business or saved for future needs.

Additionally, strategic tax planning includes making quarterly estimated tax payments to avoid penalties and interest charges. A tax professional can provide invaluable guidance, ensuring that self-employed individuals take full advantage of tax-saving opportunities and remain in good standing with tax authorities.

Retirement Planning: Investing in Your Future

The absence of employer-sponsored retirement plans means the self-employed must take the initiative in securing their financial future. Exploring retirement savings options, such as SEP IRAs, Solo 401(k)s, and Roth IRAs, allows individuals to choose the best vehicle for their retirement savings, factoring in contribution limits, tax advantages, and investment flexibility.

Committing to regular contributions towards retirement savings is crucial, even when income is unpredictable. Establishing automatic transfers to retirement accounts ensures that savings grow over time, leveraging the power of compounding interest to build a substantial nest egg for the future.

Debt Management and Credit: Balancing Growth and Risk

Effective debt management is essential for maintaining financial health and facilitating business growth. Self-employed individuals must prioritize debt repayment, focusing on high-interest debts while maintaining a good credit score. This balance is critical for accessing favorable terms on loans and credit, which can be instrumental in business expansion and securing operational needs.

Building and maintaining a strong credit score opens doors to financial opportunities and is a testament to a business’s financial reliability. Regular monitoring of credit reports, timely payments, and judicious use of credit facilities are all practices that contribute to a healthy credit profile, crucial for long-term financial success.

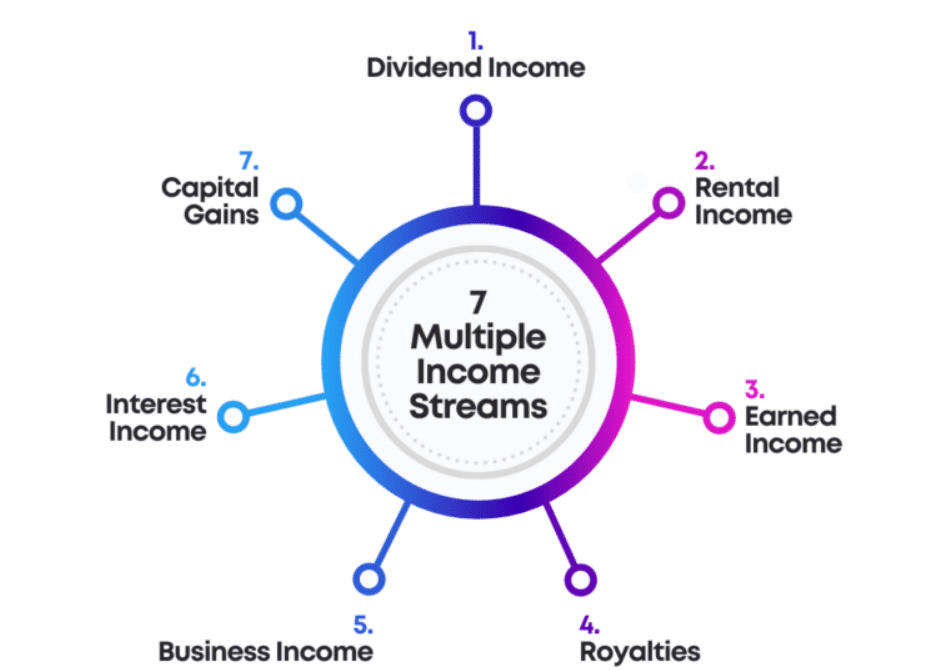

Expanding Your Income Streams: Diversification and Growth

Income diversification is a strategic move for the self-employed, buffering against the financial instability of relying on a single income source. By developing multiple income streams, individuals can mitigate the risks associated with self-employment, ensuring a more stable financial footing even in the face of industry downturns or seasonal fluctuations.

Passive income streams, such as rental income, dividend investments, or digital products, can supplement active income, providing financial security without requiring constant attention. Pursuing such opportunities should align with one’s financial goals and capabilities, ensuring that efforts to diversify income complement the core business activities.

Leveraging Technology for Financial Management

In today’s digital age, many financial management tools are available to simplify the complexities of handling finances for the self-employed. From budgeting apps that track spending and income to accounting software that streamlines invoicing and tax preparation, these tools offer invaluable resources to maintain financial order and efficiency. Embracing financial management technology saves time and provides insights into financial health, enabling more informed decision-making.

Furthermore, it is vital to stay informed about financial best practices and market trends. The self-employment landscape is ever-evolving, with new tools, laws, and strategies emerging regularly. Subscribing to financial newsletters, attending workshops, and consulting with financial advisors can keep self-employed individuals at the forefront of financial management, ensuring they leverage the best tools and information available to secure and grow their financial future.

Final Thoughts

For the self-employed, mastering the art of financial management is not just about surviving; it’s about thriving. The journey to financial stability and success is paved with challenges, but it is entirely achievable with the right strategies, tools, and mindset. From establishing a solid financial foundation to leveraging technology for efficient management, the smart money moves outlined in this article serve as a comprehensive guide for anyone navigating the complexities of self-employment. Embracing these practices will safeguard against financial uncertainty and open up opportunities for growth and prosperity. As self-employed professionals continue to shape their paths, integrating these financial strategies will ensure they are well-equipped to meet their goals, secure their futures, and realize their full potential in the dynamic world of self-employment.