In today’s ever-changing economic landscape, being financially secure is more important than ever. A major recession can test the strength of even the most robust financial plans, leaving unprepared individuals vulnerable. Understanding the signs of financial vulnerability can help you prepare better and withstand the pressures of economic downturns.

Contents

- 1. Insufficient Emergency Savings

- 2. High Debt-to-Income Ratio

- 3. Lack of Diverse Income Streams

- 4. No Financial Plan

- 5. Overreliance on Credit

- 6. Inadequate Insurance Coverage

- 7. Lack of Liquid Assets

- 8. Poor Investment Knowledge

- 9. No Budgeting Practices

- 10. Ignoring Economic Indicators

- Navigating Through Uncertainty: Wrapping Up and Moving Forward

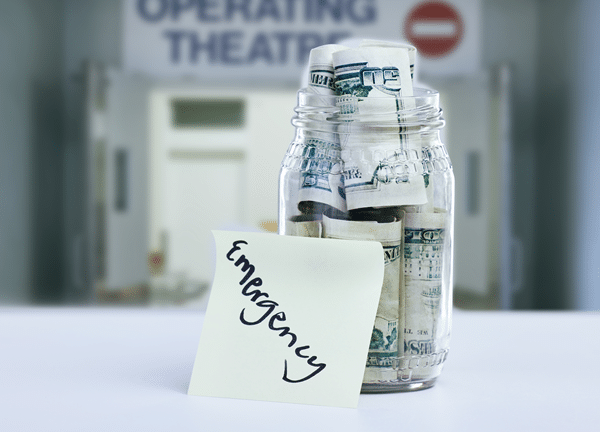

1. Insufficient Emergency Savings

One of the most critical indicators of financial unpreparedness is not having an adequate emergency fund. Financial experts often recommend setting aside enough savings to cover at least 3-6 months of living expenses. If you find yourself with less, you’re not alone, but it’s crucial to address this gap. Start small, save consistently, and gradually build a fund that can help you manage unexpected financial shocks without spiraling into debt.

2. High Debt-to-Income Ratio

Your debt-to-income ratio is a key financial metric, reflecting the percentage of your monthly income that goes towards paying debts. A high ratio means more of your earnings are tied up in debt repayments, leaving less room for savings and other expenses. This can be particularly problematic in a recession when income may decrease. Tackling this issue might involve refinancing high-interest debts or prioritizing debt repayment to improve your financial flexibility.

3. Lack of Diverse Income Streams

Relying on a single income source can be risky, especially if job cuts become widespread. Diversifying your income through side gigs, freelance work, or passive income investments can provide a safety net that helps soften the impact of job loss. Start exploring options that align with your skills or interests and consider how you can develop additional income streams.

4. No Financial Plan

Without a clear financial plan, steering through a recession can be like navigating without a map. This plan should outline your budget, long-term savings goals, and investment strategies. Begin by assessing your current financial situation, set clear, achievable goals, and regularly review your plan to ensure it remains aligned with your financial reality and objectives.

5. Overreliance on Credit

If you find yourself frequently leaning on credit cards for everyday expenses or emergencies, you might be too dependent on borrowed money. This can lead to unsustainable debt levels, especially if a recession leads to tighter credit conditions. Work on building your savings and reducing credit card usage to manage your finances more sustainably.

6. Inadequate Insurance Coverage

Adequate insurance (health, property, and auto) acts as a buffer against unexpected financial expenses. Inadequate coverage can lead to significant out-of-pocket costs in the event of medical issues or accidents, which can be financially devastating during a recession. Review your policies to ensure they provide adequate coverage and consider if additional types of insurance are necessary for your situation.

7. Lack of Liquid Assets

Liquid assets are those you can quickly convert to cash without significant loss in value. During a recession, having access to liquid assets is crucial to cover unexpected expenses without incurring debt. Review your investment portfolio and consider if you need to increase your holdings in more liquid assets like savings accounts or money market funds.

8. Poor Investment Knowledge

Investing without a solid understanding of the markets can lead to poor decision-making, especially in volatile times. Enhance your investment knowledge through books, courses, or by consulting with a financial advisor. Educated investing will help you make more informed decisions and potentially safeguard your investments from severe downturns.

9. No Budgeting Practices

Budgeting is fundamental to maintaining financial health. It helps you track your income and expenses, ensuring you live within your means and save adequately. If you don’t already budget, start by documenting your monthly income and expenses. Use budgeting apps or templates to help you manage your finances more effectively.

10. Ignoring Economic Indicators

Staying informed about the broader economy can help you anticipate changes that might affect your financial situation. Key indicators such as unemployment rates, GDP growth, and consumer confidence can provide insights into economic trends. Keep abreast of these indicators through reliable financial news sources and consider how changes in the economy might impact your personal finances.

Recognizing these ten signs is the first step in fortifying your financial defenses against a recession. Each point not only highlights vulnerabilities but also offers a pathway towards greater financial security. Take proactive steps today to reassess and reinforce your financial strategies. With the right preparations, you can navigate through economic uncertainty with confidence and emerge stronger on the other side.