Living paycheck to paycheck is a reality for many, characterized by a cycle where one’s income is almost entirely consumed by expenses, leaving little to no room for savings. Breaking free from this cycle not only stabilizes your financial situation but also alleviates stress and improves overall quality of life. This guide outlines practical strategies to help you gain control of your finances and say goodbye to financial stress for good.

Understanding where every dollar of your income is going is the first step toward financial freedom. By gaining a clear view of your financial landscape, you can make informed decisions that steer you away from the paycheck-to-paycheck life.

Contents

Assess Your Current Financial Situation

The journey to financial freedom starts with a thorough assessment of your finances. Gather all your financial statements—bank accounts, bills, credit card statements—and review them to understand your total monthly income and expenditures. This overview highlights areas where you might be overspending or under-saving.

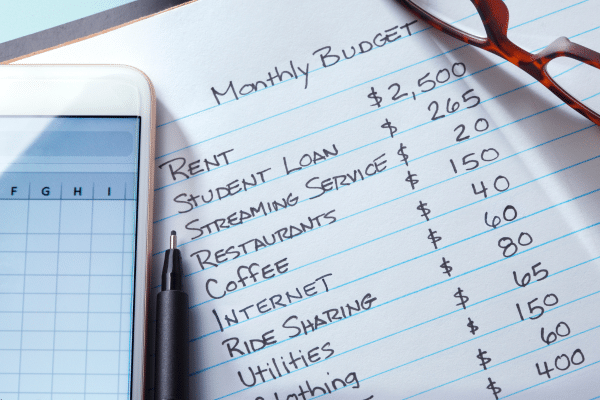

Tracking your spending can reveal surprising patterns. For a month, record every purchase, no matter how small. This exercise can expose unnecessary expenses—like daily coffee shop visits or frequent dining out—that quickly add up. Awareness is the first step towards cutting these costs and reallocating funds towards more significant financial goals.

Create a Budget That Works

Creating a functional budget is crucial. It should categorize your spending into essentials (rent, utilities, groceries), savings, debt repayments, and discretionary spending. Tools like budgeting apps or spreadsheets can help manage your finances more effectively, ensuring you stick to your financial plan.

Adhering to a budget requires discipline and adjustment. Initially, you might find some categories are unrealistic or overlooked. Regular monthly reviews will help you tweak your budget to better reflect your actual spending habits and financial goals, making it a more powerful tool in your financial stability arsenal.

Cutting Unnecessary Expenses

Reducing your expenses is easier than you might think. Start by eliminating obvious non-essentials such as unused gym memberships, subscription services, or cable packages. Even small changes, like switching to a less expensive grocery store or reducing energy consumption at home, can free up a significant amount of money.

Consider lifestyle changes that have a dual benefit. For instance, biking to work not only saves on transportation costs but also improves your health. Entertainment costs can be trimmed by opting for free community events, leveraging library resources, or hosting game nights at home instead of going out.

Boost Your Income

Increasing your income can accelerate your escape from living paycheck to paycheck. Consider freelancing, consulting in your professional field, or starting a small business based on your hobbies or skills. Even a few extra hours of paid work each week can make a substantial difference.

If a side hustle isn’t feasible, look for opportunities within your current employment to earn more, such as overtime offers or position advancements. A candid discussion with your employer about your career path can also open doors to raises or promotions.

Eliminate High-Interest Debt

High-interest debt, like credit card balances, can cripple your ability to save. Focus on paying off these debts first as they consume the most money in interest charges. Methods such as the debt snowball (paying smallest debts first for psychological wins) or the debt avalanche (focusing on highest interest rates first) can be effective strategies.

Once high-interest debts are under control, you can redirect those funds toward savings or investing, compounding your financial growth instead of your debt.

Build an Emergency Fund

An emergency fund is critical as it provides a financial buffer that can keep you afloat in difficult times without having to borrow money. Start small, aiming to save $1,000, then build it up to cover three to six months of living expenses.

Regular contributions, even small ones, can build your emergency fund over time. Treat this fund as a fixed expense within your budget to ensure it grows consistently. Once established, this fund protects you against the need to go into debt for unexpected expenses.

Plan for the Future

Long-term financial planning involves more than just escaping paycheck-to-paycheck living; it’s about setting yourself up for future wealth. Consider starting contributions to a retirement account or investing in stocks or mutual funds. Understanding basic investment principles can significantly increase your long-term financial security.

Setting goals such as buying a home, saving for retirement, or funding your children’s education can motivate you to maintain financial discipline. Visualizing these goals as tangible outcomes makes the daily management of your finances more rewarding.

Seize Financial Freedom

Breaking free from living paycheck to paycheck is a transformative journey that leads to greater financial independence and personal freedom. By implementing the strategies outlined, you’ll not only manage your money more effectively but also build a secure financial future.

Remember, the path to financial freedom is a marathon, not a sprint. Consistent efforts, discipline, and smart financial decisions will gradually but surely change your financial landscape, allowing you to enjoy the benefits of your hard work and foresight.