Retirement savings remain a pivotal aspect of financial planning, yet the strategies and challenges differ significantly across generations. This comparative analysis delves into the distinct approaches of Millennials and Baby Boomers, reflecting on how varied economic landscapes, technological advancements, and societal norms have shaped their retirement savings habits. It offers insights into the diverse methodologies and mindsets of these two generations, highlighting the evolution of financial planning over time. The goal of this discussion is not only comparing retirement savings but also understanding the underlying factors influencing each generation’s approach to securing their financial futures.

Contents

- Understanding Generational Differences

- The Retirement Landscape for Baby Boomers

- The Retirement Landscape for Millennials

- Key Differences in Retirement Savings Strategies

- Challenges Faced by Both Generations

- The Role of Financial Technology

- Future Trends in Retirement Savings

- Tips for Effective Retirement Savings

- Chart Your Path To a Secure Retirement

Understanding Generational Differences

Millennials, born between 1981 and 1996, and Baby Boomers, born between 1946 and 1964, have grown up in significantly different economic environments. Boomers experienced a period of relative economic prosperity, while Millennials have faced a series of financial crises, including the Great Recession and the economic fallout of the COVID-19 pandemic. These differing experiences have shaped their respective attitudes toward savings and investments.

On the other hand, societal expectations and norms have also played a role in shaping these generational attitudes. For instance, Baby Boomers were typically expected to secure a steady job, buy a home, and save for retirement. Conversely, Millennials have been more inclined towards experiences, prioritizing travel and personal growth over traditional markers of stability, which has had an impact on their retirement savings strategy.

The Retirement Landscape for Baby Boomers

Baby Boomers, often considered the “wealthiest” generation, have generally followed a traditional path toward retirement. Many worked with the same company for years, gradually building their retirement nest egg through employer-sponsored pension plans or 401(k) contributions. The concept of retirement as a deserved rest after years of hard work is deeply ingrained in this generation’s psyche.

However, despite their relative wealth, not all Boomers are sailing smoothly towards retirement. Some have had to delay retirement due to inadequate savings, while others have been forced to support their adult children financially. The 2008 financial crisis also dealt a significant blow to many Boomers’ retirement plans, demonstrating that this generation has not been entirely immune to economic upheaval.

The Retirement Landscape for Millennials

Millennials face a markedly different retirement landscape. Many entered the workforce during the Great Recession, which has had long-lasting effects on their earnings and savings potential. Furthermore, unlike Baby Boomers, Millennials cannot rely as heavily on employer-sponsored pension plans due to their decline in recent years.

Additionally, Millennials are burdened with unprecedented levels of student debt, making it harder for them to save for retirement. They are also more likely to job-hop, seeking better opportunities or work-life balance, making it harder to maintain consistent retirement contributions. However, despite these challenges, some Millennials are leveraging technology and alternative investment avenues to build their retirement savings.

Key Differences in Retirement Savings Strategies

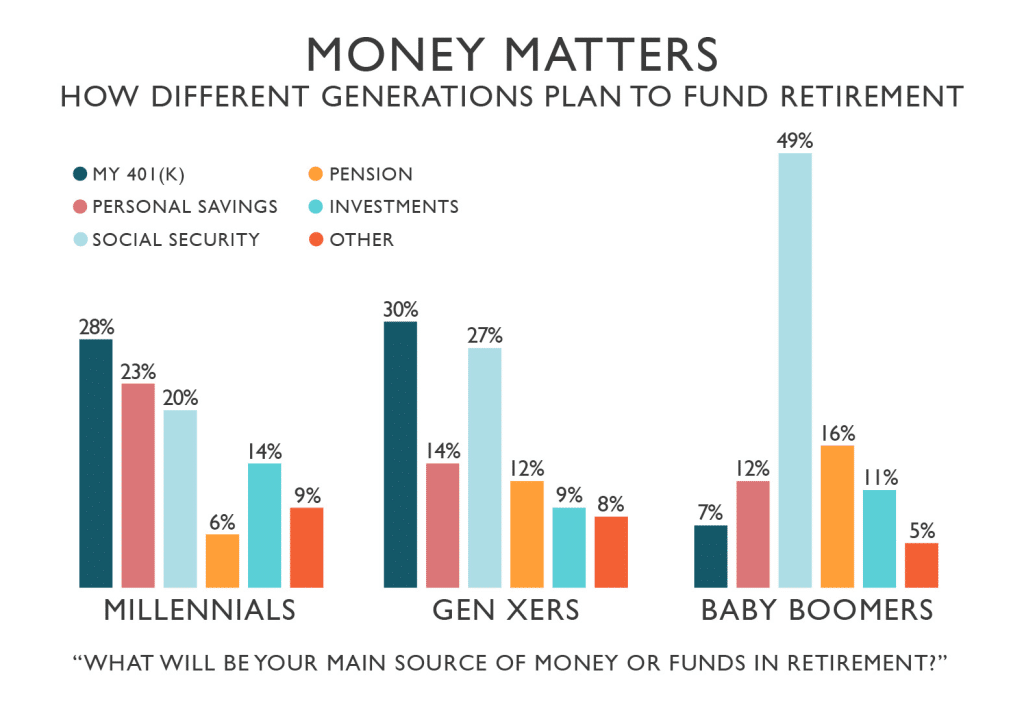

Baby Boomers and Millennials exhibit distinct retirement savings strategies, largely shaped by their respective financial climates. Boomers, for instance, have relied heavily on employer-sponsored plans and Social Security benefits. They’ve also benefited from long-term asset appreciation, particularly in the housing market, which has boosted their overall retirement wealth.

Millennials, in contrast, are increasingly looking towards alternative investment avenues, such as real estate or the stock market. Being digital natives, they are also more comfortable using investment apps and robo-advisors to manage their retirement savings. However, the burden of student loans and the high cost of living in many cities often hampers their ability to save as much as they would like.

Challenges Faced by Both Generations

Despite their differences, both generations face key challenges in saving for retirement. The rising cost of healthcare is a major concern for Baby Boomers, many of whom are already in retirement or close to it. Additionally, the decline in traditional pension plans and uncertainty around Social Security benefits add to their worries.

For Millennials, the high levels of student debt and the after-effects of the Great Recession pose significant hurdles. Many also face the challenge of balancing retirement savings with other financial goals, such as buying a house or starting a family. Despite these obstacles, it’s important for both generations to prioritize retirement savings to ensure financial stability in their later years.

The Role of Financial Technology

Financial technology, or FinTech, is playing an increasingly crucial role in how people save for retirement. Millennials, being tech-savvy, are particularly quick to adopt these tools. Investment apps, robo-advisors, and online platforms offering financial advice are becoming popular tools to help this generation navigate their retirement savings journey.

Baby Boomers, while not as tech-savvy as Millennials, are also starting to accept and use FinTech to manage their retirement savings. Online platforms that simplify the investment process and offer easily accessible financial advice are appealing to Boomers. As this trend continues, it could significantly change the retirement savings landscape for both generations.

Future Trends in Retirement Savings

As Millennials and Baby Boomers adapt to their respective financial realities, new trends in retirement savings are emerging. For instance, Millennials’ use of FinTech is likely to continue growing, potentially leading to more personalized and efficient retirement savings strategies. Moreover, as this generation values experiences over material possessions, they might also push for more flexible and portable retirement plans that accommodate their lifestyle.

For Baby Boomers, the focus may shift towards making their savings last, especially as life expectancy increases. This could lead to a greater emphasis on investment strategies that provide a steady income during retirement, like annuities or dividend investing. Furthermore, as more Boomers continue working past the traditional retirement age, you may see an increase in phased retirement strategies.

Tips for Effective Retirement Savings

Regardless of generational differences, some principles of effective retirement savings apply universally. Firstly, starting early can have a massive impact due to the power of compound interest. Regularly reviewing and adjusting saving strategies is also important to ensure they align with changing personal circumstances and economic conditions.

Another key tip is diversifying investments to spread risk. Both Millennials and Baby Boomers can benefit from a mix of different asset classes in their portfolio. Lastly, considering professional financial advice can be useful, particularly when planning for retirement. While each generation faces unique challenges, these tips can go a long way in ensuring a secure financial future.

Chart Your Path To a Secure Retirement

While Baby Boomers and Millennials face distinct challenges and have unique strategies for retirement savings, the importance of planning for the future remains constant. From leveraging FinTech to diversifying investments, there are myriad ways to navigate the financial landscape. Remember, it’s never too early or late to start planning for your retirement. Take charge today, adapt your strategy as needed, and secure a financially stable future that allows you to enjoy your golden years with peace of mind.