Financial stability, though seemingly elusive, is achievable by all families, regardless of their income level. It boils down to efficient planning and disciplined spending. The aim of this blog post is to equip low-income families with practical strategies to manage their money better. By adhering to these methods, families can gradually improve their financial health, paving the way for a less stressful and more secure future. These tips, crafted through expert advice and proven practices, are designed to be simple, doable, and effective for families striving to thrive on a low income.

Contents

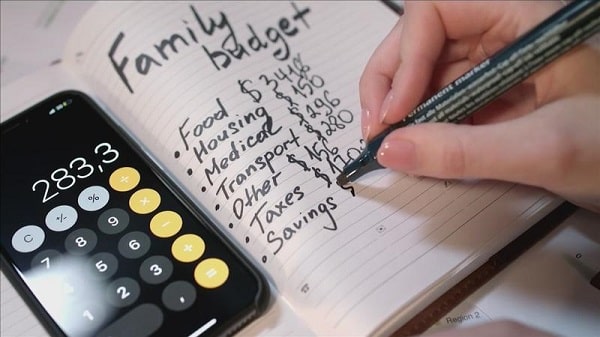

Create A Budget

Establishing a budget is the first step toward gaining control over finances. This requires taking a detailed look at all sources of income and every penny spent. By tracking earnings and expenditures, it becomes easier to understand where money is going and identify areas where costs can be reduced. The main idea here is to manage money in such a way that expenses never surpass income, thereby averting debt.

Creating a budget also facilitates distinguishing between needs and wants. Needs constitute the essentials for survival, such as food, housing, and healthcare, while wants are items desired but not necessary for survival. By putting needs first and limiting expenditures on wants, families can make the most of their income while avoiding unnecessary expenses.

Drop Unneeded Monthly Memberships

It’s not uncommon to sign up for monthly subscriptions or memberships that seem useful at first but end up being barely used. Such subscriptions could range from digital services like streaming platforms to physical memberships like gym subscriptions. It is essential to evaluate these services and eliminate the ones that aren’t actively contributing to quality of life or are just luxuries that can be lived without.

A practical way to keep track of such expenses is to maintain a spreadsheet listing all the memberships and subscriptions along with their costs. Regularly reviewing and updating this list will help identify redundant services. Redirecting the money saved from canceling these unnecessary subscriptions towards essential expenses or savings can greatly enhance financial health.

Eliminate High-Interest Debt

High-interest debt, often accrued through credit cards or payday loans, can be a constant source of financial stress. These types of debt can quickly compound, making it challenging to pay off the principal amount. By prioritizing the elimination of high-interest debt, one can save considerable amounts in the long run. The ‘avalanche’ method can be effective here, where one targets the debt with the highest interest rate first while maintaining minimum payments on other debts.

Alternatively, the ‘snowball’ method could be applied where the smallest debts are paid off first, building momentum and motivation to tackle larger debts. Regardless of the chosen strategy, the key is to consistently work towards reducing high-interest debt and eventually eliminating it. This frees up money for other financial goals and reduces the burden of interest payments.

Use Coupons

Coupons and discount codes offer a practical way to cut down on everyday expenses. With the rise of digital platforms, it has become easier than ever to find coupons for a variety of products and services. It’s not about buying more with coupons but about saving on what is already being purchased. The money saved can be allocated to more pressing financial needs or towards savings.

However, one has to be cautious not to fall into the trap of buying unnecessary items just because they are on sale or a coupon is available. The real value of coupons and discounts comes from using them to reduce the cost of necessary purchases. This strategy could significantly reduce monthly expenses, particularly in the areas of groceries and household supplies.

Build An Emergency Fund

An emergency fund serves as a financial safety net in case of unexpected expenses like a medical emergency or car repairs. Even on a tight budget, setting aside a small amount of money consistently can contribute to an emergency fund over time. Having this fund reduces financial stress and prevents the need for high-interest debt in case of unforeseen expenses.

To build an emergency fund, one should aim to set aside a small, manageable portion of income regularly. Even a small fund can provide a sense of financial security and independence. With time, the goal should be to accumulate enough to cover 3-6 months’ worth of living expenses. It is an achievable target that requires patience and discipline, but the peace of mind it brings is invaluable.

Invest In Low-Cost Meals

Cooking at home and planning meals in advance can drastically reduce food expenses compared to dining out or ordering takeaways. With a bit of creativity and research, one can create nutritious, filling meals that cost significantly less than ready-made or restaurant meals. Moreover, buying groceries in bulk, choosing seasonal produce, and using cheaper cuts of meat can contribute to additional savings.

It can be helpful to set aside some time each week to plan meals. Creating a shopping list based on this plan and sticking to it can prevent impulse purchases and reduce waste. This also provides the opportunity to look for coupons or sales that match the planned meals, further reducing grocery expenses.

Get Financial Education

Understanding money management, savings, and investments can significantly impact financial well-being. Numerous resources are available online and offline for free or at low cost that can provide financial education. Knowledge gained from these resources can help make informed decisions about money, allowing it to work harder and go further.

Resources such as books, online courses, blogs, podcasts, and community programs can provide valuable insights into various aspects of personal finance. Learning about topics such as budgeting, debt management, investing, and retirement planning can empower individuals to take charge of their financial future.

The Bottom Line

Achieving financial stability on a low income might seem like an uphill battle, but with the right strategies and discipline, it’s within reach. The steps highlighted in this blog post provide a practical roadmap to better financial health. Adopting these habits and staying committed to them can bring about a transformation in the financial situation, leading to a more secure and less stressful life. Remember, every small step towards financial prudence contributes to a brighter financial future.