In the vast world of finance, hedge funds stand out as a unique and often misunderstood investment vehicle. They’ve been hailed as the crown jewels of the investment universe, reserved for the elite and wealthy, yet criticized for their opaque operations and high fees. Despite the mixed opinions, understanding hedge funds and their strategies is essential for anyone navigating the intricate maze of modern finance. Whether considering an investment or just aiming to broaden financial knowledge, delving into the realm of hedge funds provides an enriching perspective on how money is managed at the highest levels.

Contents

The Origin and Evolution of Hedge Funds

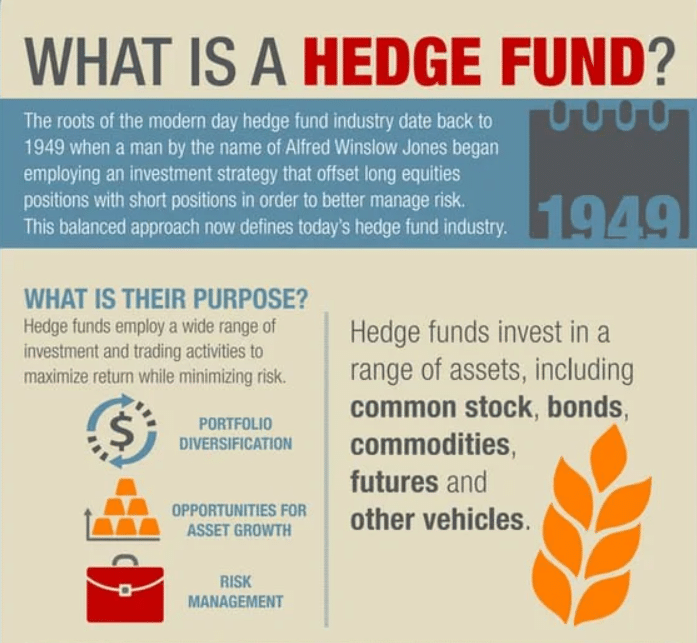

The inception of hedge funds traces back to the 1940s, with Alfred Winslow Jones being credited for creating the first fund of this kind. Adopting a unique structure, Jones combined both long and short equity positions to hedge against market downturns. This innovative approach allowed for potential profit irrespective of market conditions, setting the stage for the hedge fund industry’s rapid growth.

Over the subsequent decades, hedge funds have adapted and evolved to navigate an ever-changing financial landscape. The 1980s and 1990s witnessed exponential growth in assets under management, driven by impressive returns and burgeoning investor interest. Coupled with regulatory changes, this period also saw a diversification in strategies, as managers sought new avenues to outperform traditional markets and achieve alpha.

Fundamental Characteristics Of Hedge Funds

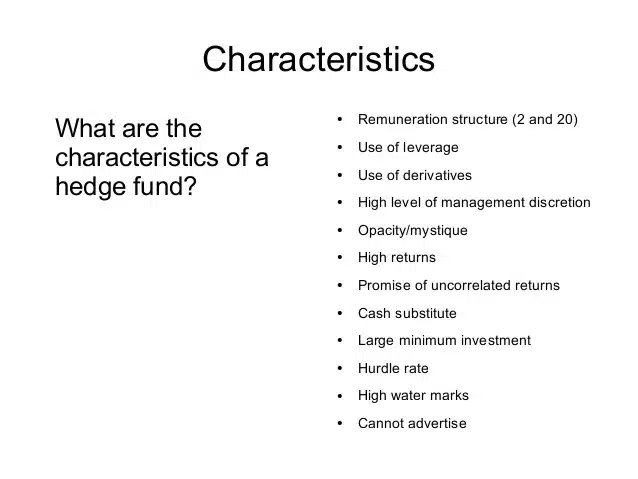

Hedge funds, at their core, differ considerably from conventional investment vehicles like mutual funds. One primary distinction is their flexibility in investment strategies. Unlike mutual funds, which might be constrained by mandates, hedge funds have the liberty to invest in an extensive range of assets, from equities to derivatives, and even unconventional assets like art or real estate.

Moreover, the fee structure of hedge funds is unique and often becomes a point of contention. Commonly known as the “2 and 20” model, managers typically charge a 2% management fee and a 20% performance fee on profits. This arrangement aligns the interests of the manager with those of the investor, as the manager’s substantial earnings come from delivering high returns. However, it also means that when hedge funds perform exceptionally well, their managers can earn significantly more than their counterparts in the mutual fund industry.

Common Hedge Fund Strategies

The diversity in hedge fund strategies is one of its distinguishing features, providing a myriad of opportunities to navigate various market conditions. Long/Short Equity, one of the most traditional approaches, involves taking long positions in stocks expected to increase in value and shorting those anticipated to decline. This duality allows managers to remain market-neutral, aiming to profit regardless of the overall market direction.

Another notable strategy is Global Macro, which focuses on making investments based on large-scale geopolitical or economic events. Managers employing this strategy may analyze interest rates, political shifts, or economic policies to determine their investments. Such a broad view requires an in-depth understanding of global dynamics, making it a strategy often left to the most seasoned hedge fund managers.

Hedging: The Core Concept

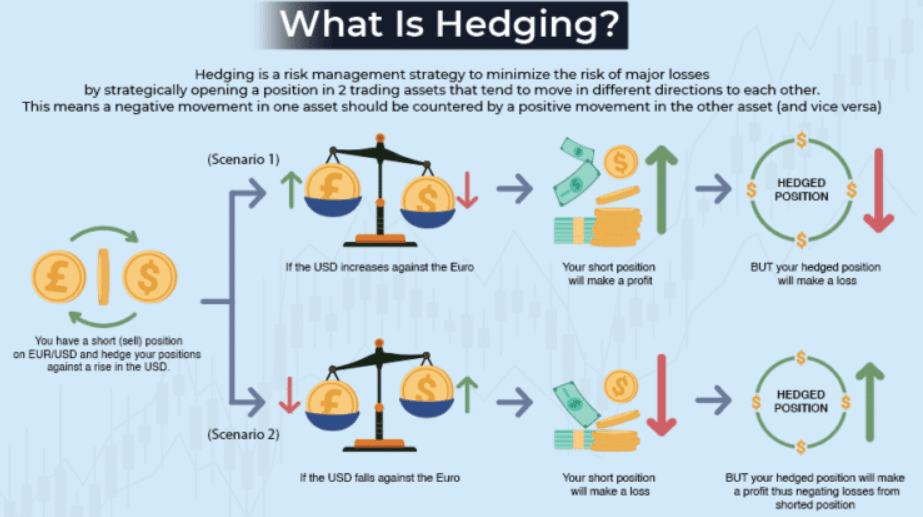

At its essence, hedging is about insurance: reducing potential losses by making an investment to offset potential negative outcomes in another position. For example, an investor bullish on technology stocks might also purchase a put option on a technology index. If tech stocks decline, the put option would likely increase in value, offsetting some of the losses.

Hedge funds employ hedging as a foundational component of their operations, but their methods can be highly intricate. They might use derivatives, short sales, or even alternative assets to create their hedges. While the goal is always risk mitigation, the tactics vary widely, reflecting the fund’s specific strategy and the manager’s outlook on the market.

Role Of Leverage In Hedge Funds

Leverage, in financial terms, refers to the use of borrowed funds to amplify potential returns. Hedge funds often employ leverage as a tool to magnify their investment capabilities, aiming to enhance returns on successful trades. However, with increased potential returns come amplified risks. If a leveraged position goes awry, the losses can be substantial, often exceeding the initial investment.

Despite its risks, leverage remains a cornerstone in many hedge fund strategies. It can be achieved through various mechanisms, including borrowing from banks or using derivatives. The level of leverage a hedge fund employs often correlates with its risk profile and the specific strategy it adopts. While some funds may use minimal leverage, others might take on substantial debt, reflecting the diversity and complexity inherent in the hedge fund industry.

The Regulatory Landscape

Hedge funds, due to their substantial influence on financial markets and unique operational characteristics, fall under specific regulatory purviews in many countries. In the United States, for instance, certain hedge funds must register with the Securities and Exchange Commission (SEC), offering transparency into their operations and investment strategies. This move towards increased transparency aims to protect investors and ensure the stability of financial markets.

Internationally, hedge fund regulations can vary widely. Some jurisdictions have stringent oversight, while others might adopt a more laissez-faire approach. However, a common trend post the 2008 financial crisis has been a global shift towards tighter regulations. This pivot ensures increased transparency, reduces systemic risks, and mandates regular reporting, thereby safeguarding both investors and the broader financial system.

Criticism And Controversies

The hedge fund industry, despite its success and allure, has not been without its share of criticism. Detractors often point to the high fee structures, arguing that the “2 and 20” model can be excessive, especially in instances where returns don’t justify such fees. This contention posits that investors might be better served with lower-cost alternatives, particularly when hedge fund performance mirrors broader market trends.

Moreover, the industry has faced its share of controversies, from allegations of insider trading to concerns about market manipulation. These incidents, while not reflective of the entire industry, have occasionally cast a shadow over its reputation. Such episodes underscore the importance of due diligence for investors and the continued need for robust regulatory oversight.

The Bottom Line

Hedge funds, with their intricate strategies and substantial influence on global markets, remain a pivotal player in the investment landscape. Their flexibility, combined with the potential for high returns, makes them an attractive proposition for many. However, like all investment vehicles, they come with inherent risks. Potential investors must tread cautiously, arming themselves with knowledge and understanding before diving into this complex world. In doing so, one can better appreciate the nuances and potential rewards that the realm of hedge funds has to offer.