In recent years, cryptocurrency has become synonymous with the promise of wealth and financial freedom. One of the ways to make money with cryptocurrency is through crypto mining. This process is essential to the functioning of blockchain networks, but it’s often perceived as daunting and unprofitable due to increased competition and high operational costs. However, with the right strategies and preparation, crypto mining can still be a lucrative endeavor.

Contents

- Understanding Crypto Mining

- How To Make Money Crypto Mining

- Assessing Your Crypto Mining Potential

- Hardware Needed For Crypto Mining

- Selecting The Right Cryptocurrency For Mining

- Understanding Mining Pools

- Strategies For Profitable Crypto Mining

- Legal And Regulatory Considerations

- Future Of Crypto Mining

- The Bottom Line

Understanding Crypto Mining

Crypto mining is the backbone of most blockchain networks. It involves the use of computational power to solve complex mathematical problems, which in turn verifies transactions and adds them to the blockchain. The reward for this work is usually in the form of newly minted cryptocurrency. Over the years, crypto mining has evolved and become more sophisticated, with miners now requiring powerful hardware to stay competitive.

Moreover, it’s important to understand that not all cryptocurrencies are mined. While Bitcoin is the most well-known mineable cryptocurrency, there are several others, like Ethereum, Litecoin, and Bitcoin Cash, that offer mining opportunities. The potential profitability of mining these cryptocurrencies can vary significantly depending on factors like market value, mining difficulty, and operational costs.

How To Make Money Crypto Mining

So, how do you make money in crypto mining? There are two main ways: mining rewards and transaction fees. When you mine a block successfully, you’re rewarded with a certain amount of cryptocurrency. Additionally, you also earn transaction fees from the transactions included in the new block. These rewards and fees can then be sold for fiat money or held in anticipation of future price appreciation.

Assessing Your Crypto Mining Potential

Before diving into crypto mining, it’s crucial to assess your mining potential. First, consider your initial capital. Purchasing mining equipment can be costly, and it’s important to ensure you can comfortably afford the initial outlay. Secondly, evaluate your understanding of the technology. At the same time, you don’t need to be a tech wizard, a basic understanding of how blockchain and mining work can significantly improve your mining experience.

Also, consider your electricity costs. Mining uses a significant amount of power, and high electricity costs can eat into your profits. Lastly, think about your available space. Mining equipment can be noisy and heat-generating, so having a dedicated space can be beneficial.

Hardware Needed For Crypto Mining

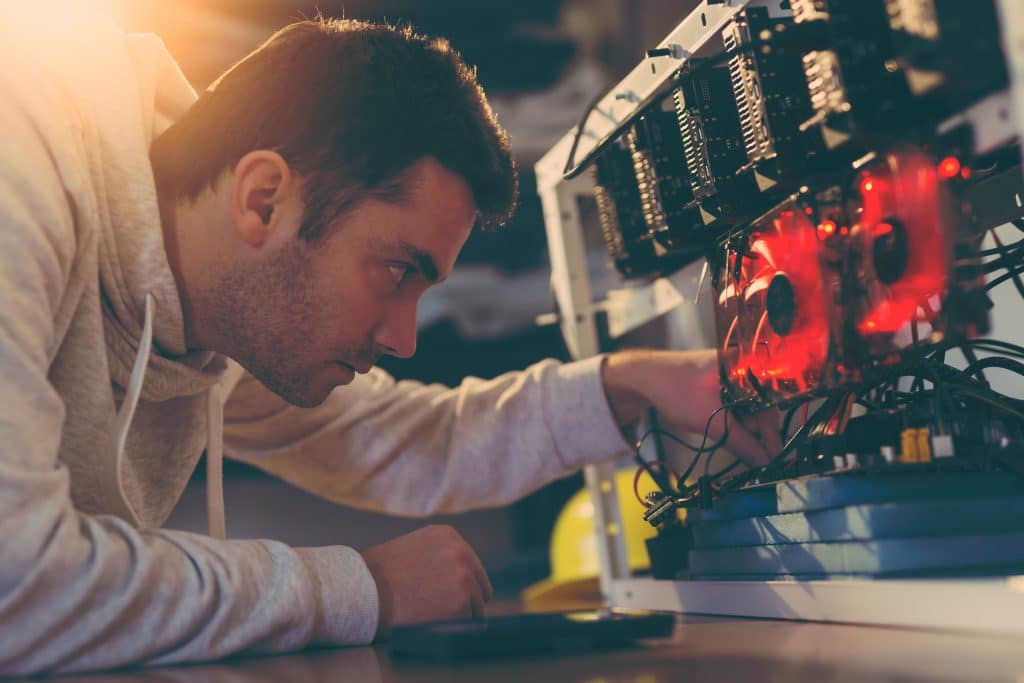

Once you’ve assessed your potential, the next step is procuring the hardware. There are three main types of mining hardware: Application-Specific Integrated Circuits (ASICs), Graphics Processing Units (GPUs), and Central Processing Units (CPUs). ASICs are the most efficient but are also the most expensive. They are specifically designed for mining a particular type of cryptocurrency.

GPUs, on the other hand, are less efficient than ASICs but are more versatile as they can mine different types of cryptocurrencies. CPUs are the least efficient but are also the cheapest. The choice of hardware will depend on your budget, the type of cryptocurrency you wish to mine, and your electricity costs.

Selecting The Right Cryptocurrency For Mining

The choice of cryptocurrency is just as important as the hardware. It’s advisable to mine a cryptocurrency that has the potential for price appreciation. Consider factors like market capitalization, liquidity, and community support. Also, consider the mining difficulty. Cryptocurrencies with high mining difficulty might be less profitable to mine, especially for beginners.

Understanding Mining Pools

Mining on your own can be challenging, especially if you don’t have a lot of computational power. That’s where mining pools come in. They are groups of miners who combine their computational resources to increase their chances of mining a block. While joining a mining pool means sharing the rewards, it can provide a more stable income compared to solo mining.

However, not all mining pools are created equal. You need to choose a mining pool that aligns with your goals and requirements. Consider factors such as the size of the pool, payout structure, and the pool’s reputation. A larger pool offers more frequent payouts, but the rewards are typically smaller. Conversely, a smaller pool offers larger payouts, but they are less frequent.

Strategies For Profitable Crypto Mining

Once you have your setup ready, the next step is to implement strategies to make your crypto mining profitable. One effective strategy is to diversify your mining activities. Instead of focusing on one cryptocurrency, consider mining several. This reduces the risk of your mining operation becoming unprofitable if one cryptocurrency’s value decreases.

Staying updated with crypto trends is also crucial. Cryptocurrencies are volatile, and staying informed about market trends and new technologies can help you make better mining decisions. Additionally, strive to use energy efficiently and maintain your mining hardware regularly. This can significantly reduce operational costs and increase the lifespan of your hardware.

Legal And Regulatory Considerations

While crypto mining can be profitable, it’s essential to remain compliant with legal and regulatory requirements. Different jurisdictions have different regulations concerning cryptocurrency and mining. Some countries fully support it, while others have imposed severe restrictions. It’s crucial to understand the legal landscape in your location before you start mining.

Additionally, crypto mining can have significant tax implications. In many jurisdictions, mined cryptocurrency is considered taxable income. Therefore, it’s advisable to consult with a tax professional to understand your tax obligations.

Future Of Crypto Mining

The future of crypto mining is full of potential, but it also comes with its fair share of challenges. Advancements in technology continue to improve mining efficiency, with new hardware and software solutions being developed regularly. However, the increasing mining difficulty and energy concerns pose significant challenges.

Additionally, the shift towards proof-of-stake consensus mechanisms in some blockchains, like Ethereum, threatens to make crypto mining obsolete. Despite these challenges, crypto mining remains a vital part of the blockchain ecosystem and will likely continue to offer opportunities for those willing to adapt and innovate.

The Bottom Line

Crypto mining can still be a profitable venture, but it requires careful planning and strategic execution. By understanding what crypto mining is, assessing your potential, choosing the right hardware and cryptocurrency, joining a mining pool, implementing profitable strategies, and staying compliant with legal requirements, you can navigate the challenges and seize the opportunities in the exciting world of crypto mining. Whether you’re a seasoned miner or a curious beginner, the crypto-mining landscape has a place for you. It’s up to you to mine it.