In the realm of digital finance, a revolutionary trend is making waves, promising to redefine the very fabric of global finance as you know it. This trend is asset tokenization, a concept that harnesses blockchain technology to convert rights to an asset into a digital token. By breaking down barriers to investment and enhancing market liquidity, tokenization is revolutionizing global finance by democratizing access to wealth-building opportunities, making it easier for people from all walks of life to invest in high-value assets. It’s a shift that not only invites broader participation in the financial markets but also heralds a new era of transparency, efficiency, and security in transactions.

Contents

Exploring the Basics of Asset Tokenization

Asset tokenization transforms the ownership of physical and intangible assets into digital tokens on a blockchain, representing a share or a right to a specific asset. This process leverages the blockchain’s innate security, immutability, and transparency, ensuring that every tokenized asset is traceable, verifiable, and less susceptible to fraud. As these digital tokens can represent anything from a piece of real estate to a work of art, the potential for tokenization is virtually limitless, opening up a world of opportunities for investors and asset owners alike.

The allure of tokenization lies in its innovative approach to ownership and its ability to make investing accessible to a broader audience. Traditionally, high-value assets like commercial real estate or rare art have been the purview of the wealthy and institutional investors. Tokenization shatters these barriers, allowing individuals to purchase tokens representing a fraction of an asset, thus lowering the entry point for investment and diversifying investment portfolios like never before.

The Technology Behind Tokenization

At the core of asset tokenization is blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology ensures that once a transaction is recorded, it cannot be altered, making blockchain a robust foundation for the tokenization of assets. The security and transparency provided by blockchain are unparalleled, offering a level of assurance to investors and asset owners that traditional transaction methods struggle to match.

Smart contracts are another pillar supporting the tokenization landscape. These are self-executing contracts, with the terms of the agreement between buyer and seller being directly written into lines of code. Smart contracts automate and enforce the terms of token transactions, minimizing the need for intermediaries and reducing the potential for disputes. This automation not only streamlines the investment process but also significantly reduces transaction costs, further lowering the barriers to entry for investors.

Benefits of Asset Tokenization

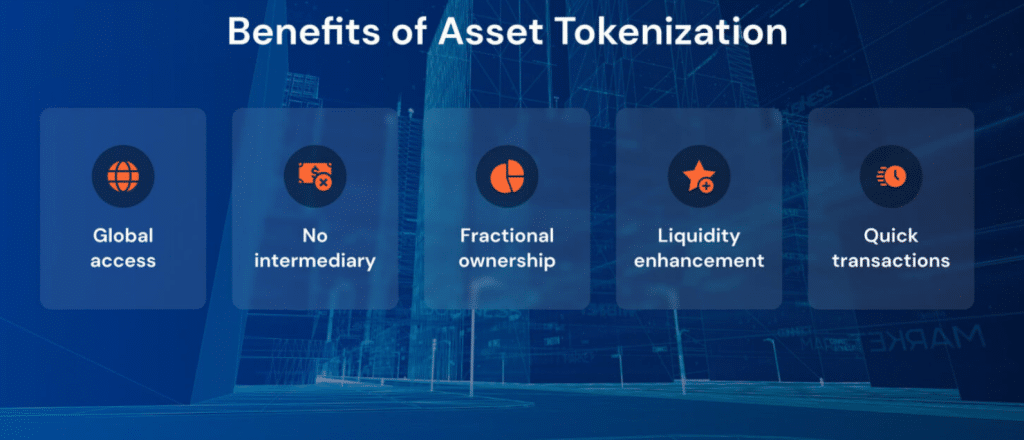

One of the most significant benefits of asset tokenization is the democratization of investment opportunities. By enabling fractional ownership, tokenization opens up markets to a wider array of investors, ensuring that more people have the opportunity to grow their wealth through investments previously out of their reach. This inclusivity fosters a more equitable financial ecosystem, where wealth-building is not just a privilege for the few but a possibility for many.

Furthermore, tokenization enhances the liquidity of traditionally illiquid assets. Real estate, for example, is notoriously difficult to sell quickly without significant loss in value. Tokenization, however, allows these assets to be traded more freely on secondary markets, providing asset owners and investors with greater flexibility and access to capital. This increased liquidity not only benefits investors but also revitalizes markets, encouraging more dynamic and responsive financial interactions.

Impact on Global Finance

Asset tokenization is reshaping the landscape of global finance, introducing new investment paradigms, and altering conventional financial processes. By facilitating more efficient and transparent transactions, tokenization is streamlining the path from investment to return, enabling quicker, more flexible, and less costly exchanges. This efficiency attracts a broader investor base and injects a new level of dynamism into the global financial system.

The regulatory landscape is also evolving in response to the rise of tokenization. Governments and financial authorities worldwide are beginning to recognize the need for frameworks that can accommodate the unique characteristics of tokenized assets. This regulatory evolution is crucial for maintaining market integrity, protecting investors, and ensuring the sustainable growth of this innovative financial sector. As regulations mature, the stability and attractiveness of tokenized assets as investment vehicles are expected to rise, further cementing their place in the financial mainstream.

Challenges and Risks

Despite the promising horizon, asset tokenization is not without its challenges and risks. One major hurdle is the technological complexity involved in blockchain and smart contracts. For many potential investors and even asset owners, the steep learning curve and understanding of blockchain technology can be daunting. This complexity can hinder broader adoption, as trust in and familiarity with these technologies are crucial for participation in tokenized markets.

Regulatory uncertainty presents another significant challenge. As asset tokenization straddles various legal jurisdictions, the lack of a unified regulatory framework can complicate participation and investment. Different countries have different rules regarding digital assets, leading to a fragmented legal landscape that can deter both investors and issuers. Until a clearer, harmonized regulatory framework emerges, navigating the legal intricacies of tokenized assets will remain a formidable barrier to their widespread adoption.

Real-World Applications and Case Studies

The practical application of asset tokenization is already making waves in various sectors, demonstrating its potential to transform traditional industries. Real estate is a prime example, where tokenization has enabled fractional ownership of property, making real estate investment more accessible and liquid. These case studies not only showcase the tangible benefits of tokenization but also serve as a blueprint for other industries looking to leverage this technology for similar gains.

In the art world, tokenization is revolutionizing ownership and investment in fine art. By breaking down ownership into tokens, collectors and investors can own a piece of valuable artwork, democratizing access to art investment and ensuring artists gain wider exposure and, potentially, more equitable compensation. These real-world applications underline the versatility and adaptability of tokenization across different asset classes, highlighting its potential to broadly impact various sectors of the economy.

Future of Asset Tokenization

Looking ahead, the trajectory of asset tokenization points toward further innovation and integration into the global financial ecosystem. Technological advancements, particularly in blockchain scalability and smart contract functionality, are expected to address current limitations, making tokenization even more efficient and widespread. As these technologies mature, the range of assets eligible for tokenization will likely expand, encompassing new and diverse sectors.

The integration of traditional financial institutions with tokenization platforms is anticipated to bridge the gap between conventional and digital finance, fostering broader acceptance and use of tokenized assets. Banks and investment firms exploring or adopting tokenization signal a significant shift, indicating the potential for a more inclusive financial system where digital and traditional assets coexist. This convergence is poised to further propel the growth and acceptance of asset tokenization, marking a new chapter in financial history.

A New Era of Investment Begins

The journey through the realm of asset tokenization reveals a landscape brimming with potential, set to reshape the contours of global finance. With its power to democratize access to investment, enhance market liquidity, and foster sustainability, tokenization stands at the frontier of a financial revolution. As it overcomes challenges and matures alongside regulatory frameworks, its integration into the fabric of global finance promises a more inclusive, efficient, and transparent financial future for all.