Paying for college is a significant concern for many families and students, especially with the escalating costs of higher education. This comprehensive guide explores various strategies and options available to manage these expenses effectively. From understanding the breakdown of college costs to exploring financial aid, scholarships, and loans, this guide aims to equip readers with essential information to make informed financial decisions for their college education.

Contents

Understanding College Costs

The cost of attending college extends beyond tuition fees. It includes a range of expenses such as room and board, textbooks, lab fees, and other necessary supplies. Prospective students should familiarize themselves with these costs to create a realistic budget. Colleges often provide a ‘cost of attendance’ estimate, which can serve as a guideline, but it’s important to remember that personal expenses can vary based on lifestyle and needs.

Budgeting for college involves more than just accounting for the advertised tuition. It’s crucial to consider additional costs like transportation, personal expenses, and in some cases, study abroad program fees. Early financial planning can alleviate the stress associated with these expenses. Tools like online budget calculators can be useful for prospective students and their families in planning their finances for the duration of the college program.

Federal And State Financial Aid

Navigating federal financial aid begins with completing the Free Application for Federal Student Aid (FAFSA). This form is crucial for students seeking federal loans, grants, and work-study opportunities. Eligibility for federal aid depends on factors like family income, assets, and the number of family members attending college simultaneously. Timely submission of the FAFSA is essential as some aid is awarded on a first-come, first-served basis.

State-sponsored financial aid programs can also provide substantial support for college expenses. These programs vary widely by state and may offer grants, scholarships, or tuition waivers for eligible residents. To maximize potential aid, students should research and apply for state-specific financial aid in addition to federal aid. Information about these programs is typically available through state education agencies and college financial aid offices.

Scholarships And Grants

Scholarships are an excellent source of funding as they don’t require repayment. Students can find scholarships offered by private companies, non-profit organizations, and universities themselves. It’s essential to apply for as many scholarships as possible, including those that might seem small, as they can add up significantly. Scholarship searches can be conducted through online databases, high school guidance offices, and community organizations.

Grants, like scholarships, do not need to be repaid and are often based on financial need. Federal grants, such as the Pell Grant, are determined through the FAFSA application. There are also subject-specific grants available for students pursuing particular fields of study or career paths. Thorough research and early application are key to securing these forms of aid, which can substantially reduce the financial burden of college.

Student Loans: Federal vs. Private

Federal student loans offer numerous benefits, including fixed interest rates and income-driven repayment plans. These loans, provided by the government, often have lower interest rates compared to private loans and do not require credit checks or co-signers for most undergraduate students. Moreover, federal loans come with deferment and forbearance options, providing flexibility during financial hardships or after graduation.

Private student loans, offered by banks, credit unions, and other financial institutions, can supplement federal loans when additional funds are needed. However, these loans typically have variable interest rates and more stringent credit requirements. It’s crucial to compare interest rates, repayment terms, and borrower protections before choosing a private loan. Students should consider private loans only after exhausting federal aid, scholarships, and grants, as they generally offer less favorable terms.

Work-Study Programs And Part-Time Jobs

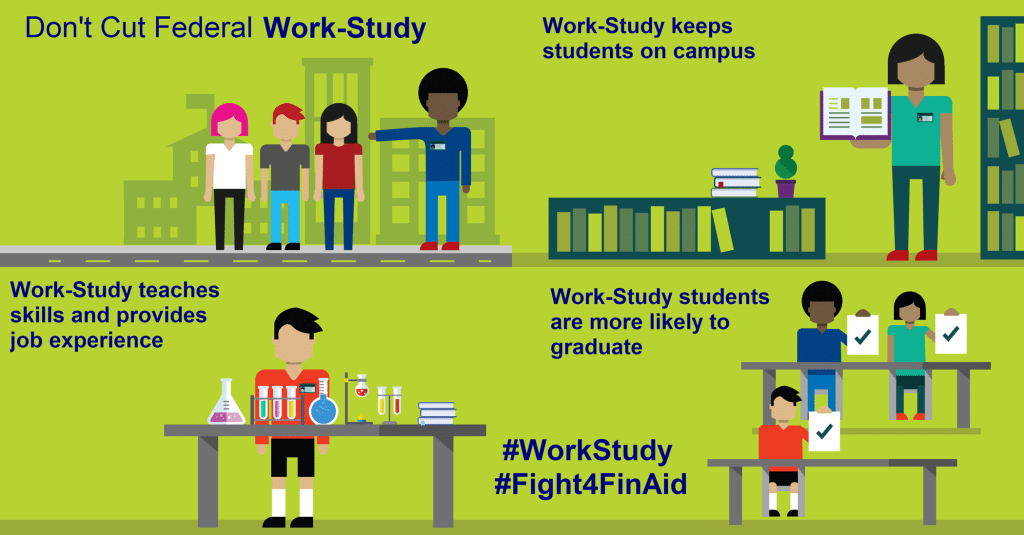

Federal work-study programs provide part-time employment opportunities for students with financial need, allowing them to earn money to help pay for education expenses. These jobs are often related to the student’s course of study or community service and are available both on and off campus. Participation in work-study is determined by the FAFSA and the availability of funds at the student’s school.

Balancing part-time jobs while attending college can also be an effective way to manage expenses. Part-time employment offers practical experience and skill development, along with financial benefits. However, it’s important to maintain a balance to ensure academic success. Students should seek jobs with flexible hours that can accommodate their class schedules and study commitments.

Saving Strategies Before College

Early savings can significantly ease the financial burden of college. Plans like 529 college savings accounts offer tax advantages and are specifically designed for education expenses. Contributions to these plans can grow over time and be used tax-free for qualified education expenses, including tuition, room and board, and textbooks.

High-yield savings accounts are another viable option for families and students aiming to save for college. Unlike regular savings accounts, these offer higher interest rates, helping savings grow more quickly. Starting to save early, even with small amounts, can make a significant difference by the time a student is ready to attend college. Consistent saving, coupled with informed investment choices, can build a solid financial foundation for future educational expenses.

Alternative Pathways To Reduce Costs

Community colleges and online courses offer cost-effective alternatives to traditional four-year universities. Community colleges typically have lower tuition rates and allow students to complete general education requirements before transferring to a four-year institution. Online courses can also reduce costs, providing flexibility and often lower tuition rates.

Considering a gap year, internships, or apprenticeships can also be financially strategic. These options allow individuals to gain practical experience and save money before embarking on their college journey. They can provide valuable insights into career paths, potentially leading to more informed decisions about one’s field of study and reducing the likelihood of costly changes in major.

The Bottom Line

Navigating the financial aspects of college education requires careful planning and consideration of various funding options. From understanding the breakdown of college costs to exploring scholarships, grants, and loans, it is crucial to examine all available resources. Early planning and informed decision-making are key to successfully managing college expenses without incurring excessive debt. Ultimately, the goal is to find a balance between affordable financing options and the pursuit of educational goals, ensuring a solid foundation for future success.