Gold has long been coveted for its luster and enduring value. As an asset, it has woven its way through the fabric of global economies, serving as a standard for wealth and a hedge against inflation and currency devaluation. In today’s volatile market, investors often ponder whether gold is a wise addition to their portfolio. This post delves into various aspects influencing whether now is a good time to invest in gold, aiming to provide a comprehensive understanding of its role in modern finance. With economic fluctuations and geopolitical tensions on the rise, assessing the timing and rationale for investing in gold has never been more pertinent.

Contents

The Historical Performance of Gold

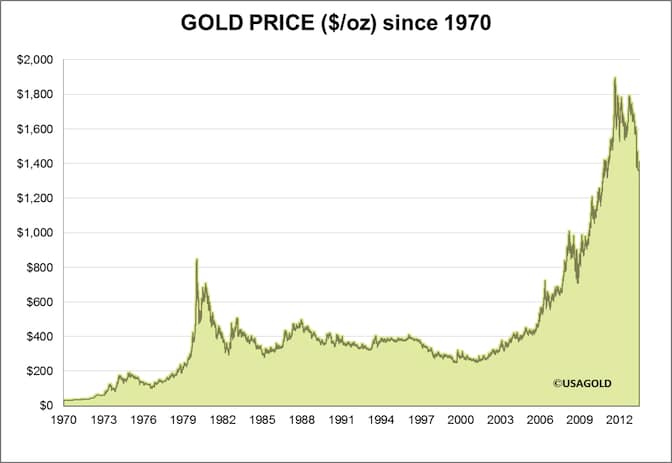

Gold’s value has been acknowledged for centuries, often seen as a symbol of wealth and a store of value. Despite its age-old allure, its performance as an investment has seen various phases. Over the last few decades, gold has experienced significant price fluctuations, reflecting changes in economic conditions, inflation rates, and investor sentiment. Historical peaks and troughs have often been aligned with global economic crises or periods of rampant inflation, underscoring its reputation as a safe haven asset.

Comparing gold to other investment options reveals a unique stability and resilience. While stocks, bonds, and real estate have gone through periods of high volatility and sometimes drastic losses, gold has maintained a relatively stable value over the long term. Its inverse relationship with the stock market often makes it a desirable counterbalance in diversified investment portfolios. However, it’s crucial to understand that gold’s past performance is not a guaranteed indicator of future results, necessitating a look at broader economic and geopolitical indicators.

Economic Indicators & Gold

Gold’s value is notably influenced by inflation. Traditionally, as inflation rises, so does the price of gold. This is because gold is priced in currency units, and as the value of the currency falls due to inflation, it takes more of that currency to purchase the same amount of gold. Investors often turn to gold to preserve their wealth against the eroding value of their national currency, making it an essential part of the discussion on investment strategies during inflationary periods.

Currency fluctuations, particularly those involving the US dollar, significantly impact gold prices. Gold is often seen as an alternative to holding currency, and when the dollar weakens, gold usually strengthens as an investment. This relationship is also evident in times of uncertainty when investors might prefer tangible assets over currency-based assets. However, this dynamic is not isolated and is interlinked with other factors like interest rates, economic data, and global economic health, presenting a complex picture for potential investors.

Global Political Climate & Gold

Gold’s status as a safe haven asset comes to the forefront during periods of global political instability and economic crisis. When confidence in governments and financial markets wavers, gold’s appeal increases. Its price often surges amidst geopolitical tensions, wars, or economic crises, as seen in historical contexts like the oil crisis of the 1970s or the financial meltdown in 2008. Investors flock to gold, seeking to protect their wealth from uncertainty and potential losses in other markets.

The influence of geopolitical tensions on gold is multifaceted. Not only does it affect investor sentiment, but it can also impact gold’s supply chain, as mining and distribution are global activities vulnerable to political unrest. For example, sanctions or conflicts in gold-producing countries can lead to supply shortages, driving up prices. Therefore, keeping an eye on global political developments is crucial for understanding potential shifts in gold’s supply and demand dynamics and, consequently, its price.

Gold Vs. Other Investment Options

When considering diversification, gold stands out for its low correlation with other financial assets. During times when equities or bonds are underperforming, gold often maintains its value or even appreciates, providing balance to an investment portfolio. Its unique characteristics derive from its physical properties, historical role, and investor perception, making it a distinct asset class that can mitigate risk in a wide range of economic scenarios.

The risk and return profile of gold differs significantly from other investment options like stocks or real estate. While it might not offer the same growth potential as some high-performing stocks or the income generation of real estate, its value preservation aspect is compelling. Investors often allocate a portion of their portfolio to gold as insurance against systemic risk or severe market downturns. However, it’s crucial to weigh gold’s opportunity cost and consider it as part of a broader, well-balanced investment strategy.

Technological Advancements Affecting Gold

The gold industry has not been left behind in embracing technological advancements. Innovations in mining technology have allowed for more efficient extraction and processing of gold, potentially increasing supply and lowering production costs. These advancements can lead to a decrease in gold’s scarcity value and affect its overall market price. Moreover, technological improvements in exploration are continually uncovering new gold deposits, further influencing the dynamics of supply and demand in the gold market.

Technology also revolutionizes how individuals invest in gold. The rise of digital gold products, gold-backed cryptocurrencies, and exchange-traded funds (ETFs) has made investing in gold more accessible and appealing to a broader audience. These digital options offer increased liquidity, lower transaction costs, and the convenience of easy buying and selling, attracting a new generation of investors. However, the digitalization of gold also introduces new risks and considerations, including cybersecurity threats and regulatory changes.

Environmental and Social Considerations

The environmental impact of gold mining is significant, involving extensive land disturbance, water usage, and chemical pollution. As environmental awareness and regulation increase globally, the gold industry faces pressure to reduce its environmental footprint. This movement toward more sustainable and responsible mining practices affects production costs and, potentially, the supply of gold. Investors increasingly prefer gold from sources that adhere to high environmental and ethical standards, influencing market dynamics and pricing.

Social considerations are also becoming increasingly important in the gold investment discourse. Issues such as labor rights, indigenous rights, and community impact are critical in evaluating the ethical implications of gold mining operations. Companies that fail to address these social issues may face reputational damage, legal challenges, and reduced investor interest. Consequently, the push for responsible and ethical sourcing of gold is shaping the industry, with certifications and standards emerging as key factors in investment decisions.

Timing The Market

Timing the market is a notoriously challenging endeavor, particularly with an asset as unpredictable as gold. While some investors attempt to buy low and sell high based on technical analysis, historical patterns, or market news, the volatile nature of gold prices makes such strategies risky. Gold’s value can be influenced by a myriad of unpredictable factors, including sudden economic changes, political events, and shifts in investor sentiment. As a result, timing the market requires not only a deep understanding of these factors but also a willingness to take on significant risks.

Despite the challenges, many still analyze historical gold price cycles and market indicators in an attempt to predict its future movements. They look at trends in inflation rates, currency values, interest rates, and geopolitical tensions, among other variables. However, even the most sophisticated analyses can’t guarantee success due to the complex and often speculative nature of the gold market. Investors considering trying to time their gold investments should be aware of the potential for significant losses and consider whether a long-term, steady investment approach might better suit their risk tolerance and investment goals.

Consider Your Golden Opportunity

In weighing the decision to invest in gold, consider the historical resilience, current market trends, and your personal financial goals. The interplay of economic indicators, technological innovations, and geopolitical climates continues to shape gold’s future. As you navigate this complex investment landscape, remain informed and consult with financial professionals to align your strategy with your objectives. Whether seeking stability, diversification, or speculative growth, take the next step in your investment journey with a thoughtful approach to gold.

Disclaimer: This article is provided for informational purposes only and is not intended as financial, legal, or investment advice. Investing in gold or any other financial instrument involves risks, including the potential loss of principal. The performance of gold and other investments varies over time, and past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified financial advisor before making any investment decisions.