The student loan debt situation has become a formidable challenge for millions, encapsulating a significant portion of the national financial landscape. As the figures soar, the urgency for individuals to navigate their debt with efficiency and strategic foresight becomes paramount. Paying off loans faster is not just about alleviating the financial burden; it’s about reclaiming freedom and paving a path toward financial independence. This comprehensive guide delves into understanding loans, budgeting effectively, choosing the best repayment strategy, refinancing options, and leveraging financial tools to accelerate the journey out of debt.

Contents

Understanding Your Loans

Understanding the nuances of student loans is the cornerstone of effective debt management. Federal and private loans, the two primary categories, diverge significantly in terms of interest rates, repayment terms, and borrower protections. Federal loans often come with fixed interest rates and a suite of repayment plans, including income-driven repayment options, which adjust monthly payments based on the borrower’s income. Conversely, banks, credit unions, and other financial institutions offer private loans, typically featuring higher interest rates and less flexible repayment options. This distinction is crucial for borrowers in crafting a repayment strategy that aligns with their financial capabilities and goals.

Utilizing a loan repayment calculator is invaluable in assessing your debt landscape. It offers a clear perspective on the total amount owed, factoring in various repayment timelines and how they impact overall interest paid. This tool aids in forging a path that suits your financial situation and optimizes the repayment process. By understanding the specifics of your loans, you’re better equipped to make decisions that can significantly reduce the duration and cost of your debt.

Budgeting for Success

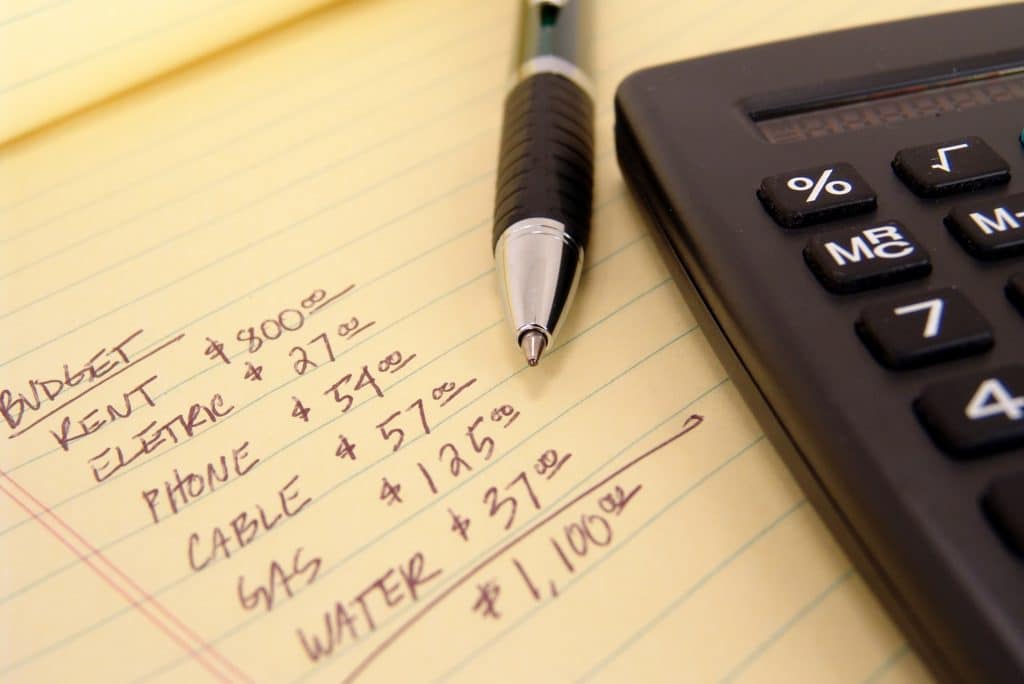

Creating a budget that prioritizes loan repayment is vital for financial success. It involves mapping out your income and expenses and identifying areas where loan repayments can be prioritized without compromising essential needs. This disciplined approach ensures that every dollar is allocated efficiently, accelerating repayment. A well-structured budget acts as a financial compass, guiding you toward your goal of debt freedom while maintaining a balanced life.

Cutting expenses to funnel additional funds toward your student loans can be a game-changer in your repayment strategy. It starts with scrutinizing your spending habits and identifying non-essential expenses that can be reduced or eliminated. This may include dining out less frequently, canceling unused subscriptions, or opting for more cost-effective entertainment options. Redirecting these savings towards your student loans can significantly shorten your repayment timeline, saving you on interest and moving you closer to financial independence.

The Snowball vs. Avalanche Methods

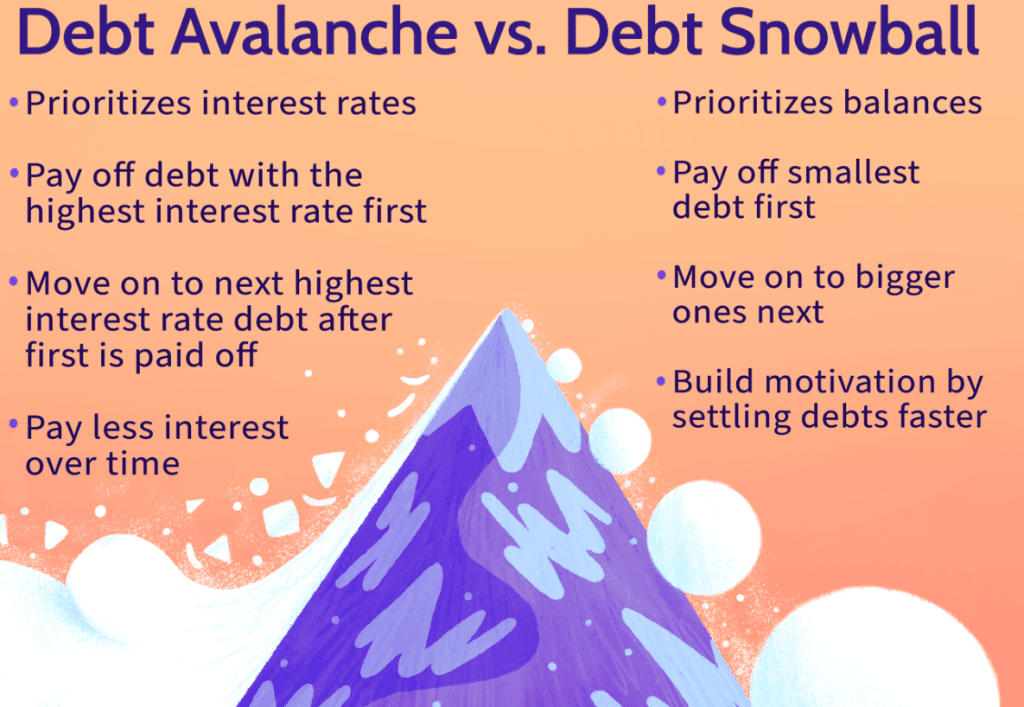

The Snowball Method focuses on paying off debts from smallest to largest, regardless of interest rates. This strategy offers psychological wins, as eliminating smaller debts provides tangible progress and motivation to tackle larger ones. It’s particularly effective for individuals who thrive on quick wins, as it helps maintain momentum and commitment to debt repayment.

Contrastingly, the Avalanche Method prioritizes debts with the highest interest rates, irrespective of the balance. This approach is mathematically advantageous, potentially saving you more interest over time. Targeting the most expensive debts first reduces the overall interest accumulation, leading to a more cost-effective and efficient debt repayment process. These methods depend on personal preference, financial goals, and the psychological impact of seeing debts cleared.

Refinancing Your Student Loans

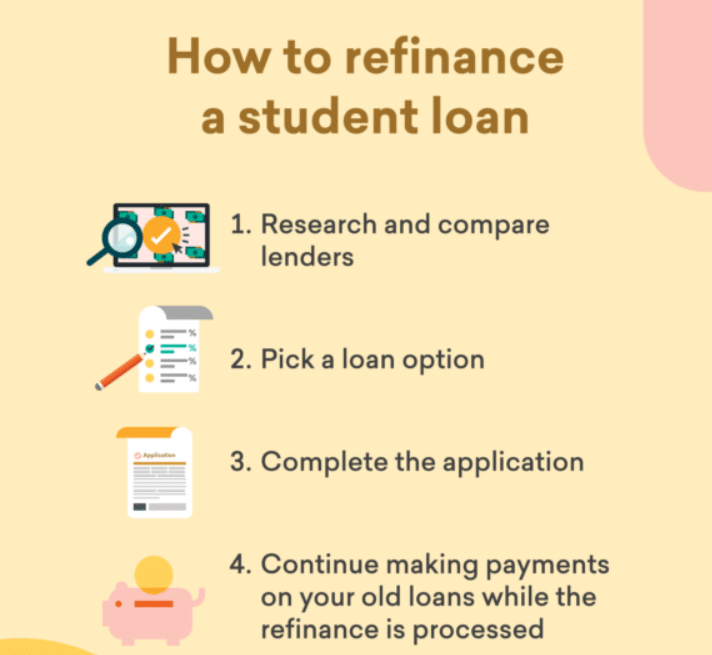

Refinancing student loans can offer a pathway to lower interest rates, a single monthly payment, and the potential for faster repayment. By consolidating multiple loans into one, borrowers often secure lower interest rates based on their credit profile, which can result in significant savings over the life of the loan. This streamlined approach simplifies the repayment process, making it easier to manage and potentially shortening the repayment period.

However, refinancing has drawbacks, particularly for federal loan borrowers. Refinancing federal loans into a private loan means losing access to federal protections, including income-driven repayment plans and loan forgiveness programs. Furthermore, borrowers should consider the implications of variable versus fixed interest rates and ensure they meet the eligibility requirements for refinancing. Weighing the pros and cons of refinancing is crucial in determining whether it aligns with your financial objectives.

Setting Up Autopay

Enrolling in autopay is a straightforward yet effective way to manage student loan repayments. Many lenders offer a slight reduction in interest rates for borrowers who utilize autopay, which can accumulate substantial savings over time. Besides the financial incentive, autopay ensures your payments are made on time every month, eliminating the risk of missed payments and late fees.

However, it’s important to maintain vigilance over your bank account to avoid potential overdraft fees. Ensuring sufficient monthly funds for the autopay deduction is critical to avoid additional financial penalties. Autopay is a tool that, when used wisely, can contribute to a hassle-free repayment experience, keeping you on track toward achieving your debt repayment.

Making More than the Minimum Payment

Paying more than the minimum on your student loans can profoundly impact the total interest accrued over the life of your loan. This approach shortens the repayment period and translates into considerable savings by reducing the amount of interest that compounds over time. By allocating extra funds to your loan’s principal balance, you’re effectively decreasing the interest that accrues, showcasing a proactive strategy toward debt management.

Finding additional funds to exceed minimum payments might seem daunting, but it can be achieved through various strategies. This may include taking on a side job, reallocating the budget from non-essential expenses, or even dedicating any pay raises towards your loans. Each extra payment directly reduces your principal balance, emphasizing the importance of scrutinizing your budget for opportunities to accelerate your loan repayment.

Using Windfalls Wisely

Windfalls, such as tax returns, bonuses, or inheritances, present a unique opportunity to make significant strides in your student loan repayment. Defining a windfall as any unexpected or non-regular income, applying these funds toward your student loan balances can dramatically alter your repayment timeline. The strategic use of windfalls to reduce or eliminate large chunks of debt can significantly decrease the interest accrued, moving you closer to financial independence.

When receiving a windfall, allocating these funds towards immediate gratification or non-essential expenses is tempting. However, dedicating a substantial portion, or even all, of this income towards your student loans can impact your financial health. This disciplined approach reduces your debt burden and accelerates your path out of debt, proving to be a wise financial decision in the long run.

Seeking Loan Forgiveness and Assistance Programs

Exploring loan forgiveness programs can offer a path to debt relief for borrowers with federal student loans. Programs like Public Service Loan Forgiveness (PSLF) are designed to forgive the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Additionally, various state-sponsored repayment assistance programs for professionals in certain fields, such as healthcare, education, and law, offer another avenue for loan forgiveness.

Employer assistance programs are also becoming more prevalent, with some companies offering student loan repayment as a benefit to their employees. These programs can significantly reduce your loan balance and should be considered when evaluating employment opportunities. Engaging with these programs requires due diligence and understanding the eligibility criteria, but those who qualify can provide a substantial financial reprieve.

Leveraging Tax Deductions and Credits

Taking advantage of tax deductions and credits related to education expenses can provide additional financial relief. The Student Loan Interest Deduction allows you to deduct up to $2,500 of the interest paid on your student loans from your taxable income. This deduction can lower your overall tax liability, potentially resulting in a larger tax refund that can be applied directly to your loan balance.

Furthermore, the Lifetime Learning Credit allows you to claim up to $2,000 for qualified education expenses, directly reducing your tax liability. Eligibility for these tax benefits can vary based on your income, filing status, and educational expenses, so it’s important to consult with a tax professional to maximize your benefits. Leveraging these tax deductions and credits can indirectly support your loan repayment efforts, contributing to your overall financial strategy.

The Bottom Line

Navigating the journey out of student loan debt requires a comprehensive strategy that encompasses understanding your loans, effective budgeting, choosing the right repayment method, considering refinancing, and utilizing financial tools such as autopay and windfalls. Each approach detailed in this guide offers a pathway to reduce your debt burden, save on interest, and accelerate your progress toward financial freedom. By embracing these strategies and remaining committed to your financial goals, you can transform the challenge of student loan debt into an opportunity for growth and independence.