The antique market has long been a fascinating arena for collectors and investors. As this sector continues to flourish, there is a growing demand for authentic, rare, and valuable items that serve as beautiful pieces of history and profitable investments. Making an informed decision in antique investments requires a thorough understanding of various factors such as authenticity, rarity, demand, and economic conditions. This article aims to guide the reader through the intricate art of evaluating antique investments, covering essential topics from assessing authenticity to understanding market trends. Ultimately, the objective is to give potential investors the necessary insights to make well-informed, profitable decisions in the antique market.

Contents

The Fascination With Antiques

Emotional Value vs. Investment Value

Many people begin their journey in the antique world for sentimental reasons or a fascination with history. This emotional connection often blurs between an item’s emotional value and investment value. Separating these two aspects is crucial, as an emotional attachment can lead to overestimating an antique’s worth, thereby skewing its actual investment potential.

Investment Potential in the Antique Market

Over the years, the antique market has proven to be a lucrative investment area. High-profile sales of antiques in prestigious auction houses have captured the public’s imagination, drawing more people into this complex yet rewarding field. Trends indicate a steady appreciation of high-quality, rare antiques, making them a potential long-term investment. Understanding these trends is essential for anyone looking to enter the antique market, focusing on financial gain.

The Different Types of Antique Investments

Collectibles

One of the first steps in making an informed investment in antiques is identifying the antiques likely to be appreciated over time. Collectibles such as rare stamps, coins, and other memorabilia have seen steady growth in value. These items often appeal to a broad audience, making them relatively liquid assets that can be easily converted into cash.

Art Pieces

Investing in art pieces like paintings or sculptures can be trickier, given the subjective nature of art. However, art pieces by renowned artists or those with historical significance have consistently risen in value over the years. Like other high-value antiques, art requires a deeper understanding of the factors contributing to its valuation, making it a more complex but potentially rewarding investment.

Assessing Authenticity

Physical Inspection

One of the key steps in evaluating an antique is determining its authenticity. Physical inspections can reveal crucial details about the item’s age, condition, and origins. Factors such as wear and tear, markings, or any repairs should be carefully noted. Authentic antiques often carry signs of age that are difficult to fake, providing important clues to their genuineness.

Provenance

Another critical factor in assessing an item’s authenticity is its provenance or its documented history. A well-documented provenance can significantly increase an item’s value and desirability. It serves as evidence of authenticity and may also provide insights into the item’s historical significance. Lack of provenance does not necessarily mean the item is not authentic, but it can make the valuation process more challenging.

The Role of Rarity and Demand

Supply Scarcity

In the world of antiques, rarity often translates to higher value. Items produced in limited quantities or those that have survived the test of time in excellent condition are generally more desirable. However, rarity alone doesn’t guarantee a high valuation. An antique must also be in demand to command a high price, which leads to the next critical factor in antique valuation: market demand.

Market Demand

An antique item’s rarity and quality are significant, but these factors could become irrelevant in determining its market value without demand. Trends in consumer taste can greatly influence which antiques are in demand at any given time. Investors should keep a pulse on market trends to gauge which items will likely appreciate. Understanding supply and demand dynamics is key to successful antique valuation and investment.

Economic Factors Influencing Antique Values

Market Trends

Economic conditions often play a significant role in the valuation of antiques. For instance, during times of economic downturn, luxury investments like antiques may see a price dip. Conversely, a thriving economy could increase demand and prices for rare items. Investors need to know the larger economic landscape and how it influences the antique market. This knowledge allows for strategic buying and selling, optimizing investment returns.

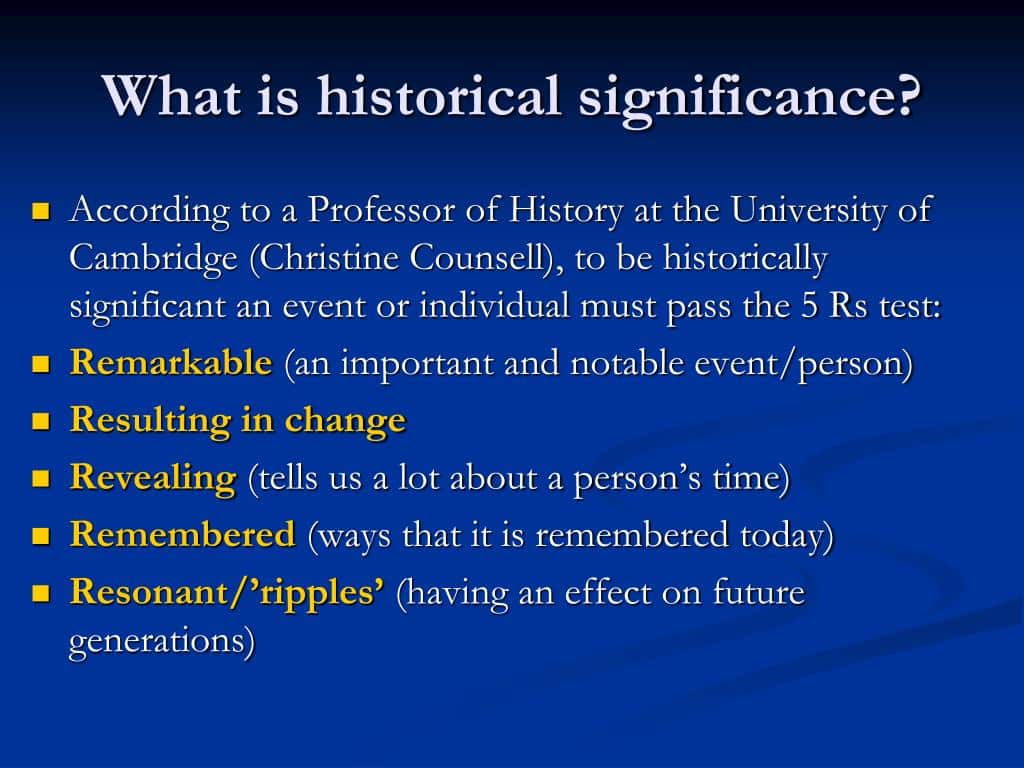

Historical Significance

Certain antiques gain additional value due to their historical significance. Items owned by notable individuals or part of significant events often command higher prices. Investors should know that historical context can greatly influence an antique’s value and should be incorporated into their valuation methods. These items often attract collectors, historians, and institutions, widening the pool of potential buyers.

Appraisal and Valuation Methods

Comparable Sales Method

One commonly employed method when valuing antiques is to compare the item in question with similar items that have been sold recently. This method, the Comparable Sales Method, offers a realistic market-based valuation. Auction results, online sales records, and dealer prices can provide valuable data for this approach. While it’s a reliable method, investors should be cautious to ensure that the items being compared are similar in terms of condition, age, and provenance.

Intrinsic Value Method

Another approach to valuation involves calculating the intrinsic value of the materials that make up the antique. For example, an antique piece of furniture could be valued based on the rarity and quality of the wood and other materials used in its construction. While this method can provide a baseline value, it often fails to account for historical significance, craftsmanship, and market demand, which can significantly affect an item’s overall value.

When and How to Sell

Timing

The timing of a sale can be critical in realizing the full potential of an antique investment. Market conditions, seasonal trends, and geopolitical events can influence buyer sentiment. Timing the market is an art in itself and requires thorough research and, sometimes, a bit of luck. Investors would do well to stay updated on market trends and other influencing factors to choose the optimal time for selling their antiques.

Platforms

Choosing the right platform to sell an antique is equally important. While auction houses often provide prestige and a guarantee of authenticity to potential buyers, online platforms offer wider exposure. Each has advantages and disadvantages, including varying commission rates and audience reach. The choice of platform should align with the specific characteristics of the antique to be sold, as well as the seller’s financial goals.

Risks and Pitfalls

Emotional Over-Investment

While antiques often carry emotional or sentimental value, it’s crucial to not let these factors cloud judgment when it comes to their financial value. Emotional over-investment can lead to overvaluation, potentially resulting in financial losses. Investors need to approach valuation with a level-headed, analytical perspective to ensure that they are making sound financial decisions.

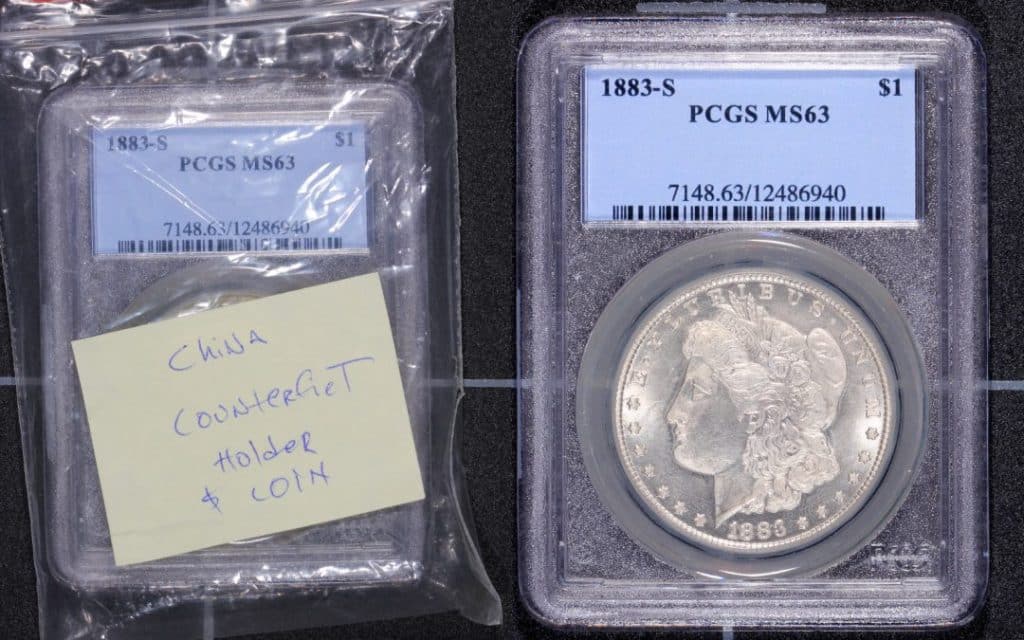

Counterfeit Risk

The risk of encountering counterfeit or misrepresented items is a real concern in the antique market. A lack of due diligence in authenticating items can lead to significant financial losses. As such, investors should always seek expert opinions and thoroughly check provenance records to mitigate the risk of investing in counterfeit items.

The Bottom Line

Navigating the complex world of antique investments requires a balanced approach combining emotional appreciation and financial acumen. This article has guided you through the crucial steps in evaluating antiques, from understanding the emotional and investment value to evaluating economic factors and market demands. It has also offered practical advice on appraising items and mitigating risks. With this comprehensive overview, you’re better equipped to make well-informed, profitable decisions in the antique market. Whether you’re a seasoned collector or a newcomer, understanding the art of antique valuation is crucial for a sustainable and profitable investment journey.