Many bank account holders are often unaware of the various hidden fees that can significantly drain their finances over time. From maintenance charges to ATM usage fees, these subtle deductions can add up, subtly reducing account balances without clear, upfront communication. Recognizing and understanding these fees is crucial for anyone looking to maintain a healthy financial status and avoid unnecessary expenses. This article explores the most common hidden banking fees, offering insights and strategies to minimize or avoid them and empowering readers to take control of their financial health.

Contents

Everyday Account Maintenance Fees

Banks frequently charge account maintenance fees to cover the costs of keeping accounts operational. These fees can vary widely from one bank to another and may depend on the customer’s account type. For instance, premium accounts often incur higher maintenance fees due to their additional services. However, not all banks make these fees apparent at the outset, which can lead to surprises on monthly statements.

To avoid these pesky fees, customers can take several measures. Maintaining a minimum balance is one common requirement to waive the monthly fee. Alternatively, setting up a direct deposit of a paycheck or similar regular income can also lead to fee waivers. For those who find it difficult to meet these requirements, it may be beneficial to consider banks that offer no-fee checking accounts, which are becoming more common as competitive banking options increase.

ATM Usage Fees

One of the more frustrating experiences for bank customers involves incurring fees for ATM usage, particularly when using machines outside their bank’s network. These fees can accumulate quickly, especially for those who often need cash on the go. Each transaction might carry a charge from both the bank and the ATM owner, which can sometimes total several dollars per withdrawal.

Minimizing these fees requires some planning and awareness. Customers are advised to locate and use ATMs within their bank’s network whenever possible. Additionally, many retail stores offer cash-back options at no extra charge, which can be a convenient, fee-free alternative to ATMs. Some banks also offer rebates on ATM fees, a feature worth looking for when choosing where to bank.

Overdraft Charges

Overdraft fees are among banks’ most costly and can create significant financial strain. These fees are levied when a customer’s account balance exceeds zero due to a charge or withdrawal. While banks often promote overdraft protection as a benefit, this service can be expensive, as it may involve substantial fees for each transaction that overdraws an account.

Avoiding overdraft fees is crucial and can be managed by closely monitoring account balances and setting up bank alerts to notify customers of low balances. Linking a savings account to a checking account for automatic transfers can prevent accounts from overdrawing. More fundamentally, keeping a buffer in the checking account can be a simple yet effective strategy to avoid these fees.

Transaction Fees Abroad

International transaction fees can quickly add up for travelers who use their debit or credit cards abroad. These fees are typically a percentage of each transaction made in a foreign currency. These fees can become a significant burden, especially for those who travel frequently or make substantial purchases abroad.

To reduce these costs, travelers should consider using credit cards with no foreign transaction fees, which can result in considerable savings. Alternatively, using local currency obtained through currency exchange services that offer competitive rates can also help avoid these fees. Understanding the fee structures of different cards is also advisable, as some may offer benefits and lower fees for international transactions.

Account Closure Fees

Closing a bank account might seem straightforward, but some banks charge a closure fee, especially if the account is closed soon after being opened. These fees are intended to dissuade customers from closing accounts prematurely and to recover the administrative costs associated with setting up new accounts. The fees vary by bank but can be a nasty surprise for the uninformed.

Customers should carefully read the terms and conditions associated with their accounts to avoid closure fees. Knowing the minimum required period to keep an account open before closing can save unnecessary costs. Additionally, engaging with customer service representatives about fee waivers for account closures can sometimes reduce or eliminate fees.

Paper Statement Fees

In an increasingly digital world, opting for paper statements can incur fees. Many banks charge for sending paper statements to encourage digital statement adoption, which is less costly and more environmentally friendly. These fees, while small per statement, can accumulate over a year.

Switching to digital statements is straightforward and often just requires adjusting the settings in one’s online banking portal. Going digital saves money and helps reduce clutter and environmental impact. Banks often provide assistance and tutorials to ease the transition from paper to digital formats for those new to digital banking.

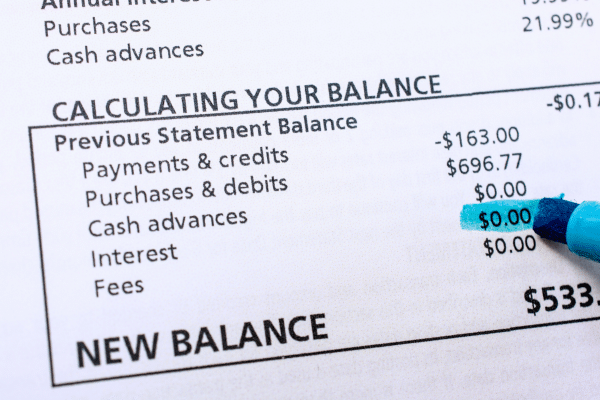

Minimum Balance Fees

Minimum balance fees are imposed when account balances fall below a specified threshold, which varies depending on the bank and the type of account. These fees can be particularly burdensome for those who have fluctuating account balances. Understanding an account’s specific requirements can help manage finances more effectively to avoid these fees.

Maintaining the minimum required balance is the most straightforward way to avoid these fees. However, choosing accounts with low or no minimum balance requirements might be a better option for those who struggle to maintain higher balances. Regular monitoring and automatic balance alerts can also help manage accounts more efficiently to prevent the imposition of these fees.

Take Charge of Your Financial Health

Understanding and managing bank fees is essential for maintaining financial health and avoiding unnecessary expenses. By becoming more aware of the types of fees banks charge and implementing strategies to avoid them, customers can retain more of their hard-earned money. Reviewing bank statements regularly, opting for banks that offer transparent fee structures, and switching to more cost-effective banking options are proactive steps everyone should consider. Empowerment through financial literacy and awareness can lead to significant savings and a better financial future.