Taking control of finances may seem daunting, but with the right plan, it can be life-changing. A one-year financial transformation is not only possible but also achievable for anyone willing to commit to small, consistent changes. From budgeting to investing, each step contributes to a solid financial foundation. This article provides actionable strategies to help readers assess their current situation, set realistic goals, and take the necessary steps to transform their financial future. With determination and focus, anyone can achieve financial stability and build a secure future in just 12 months.

Contents

Assess Your Current Financial Situation

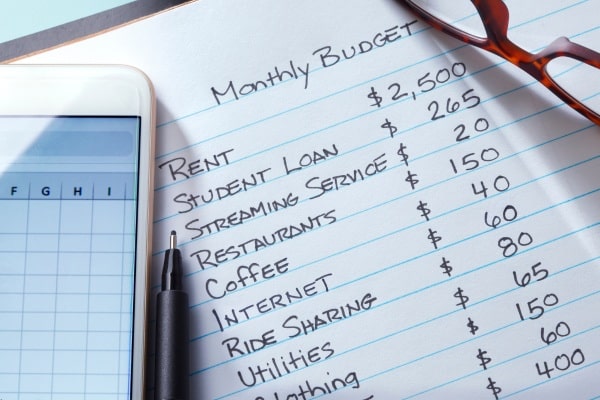

Understanding your financial baseline is the first step to making meaningful changes. A thorough assessment helps identify where money is going and uncovers hidden spending patterns. Start by calculating all sources of income, including salaries, side hustles, and passive income streams. Then, track every expense for at least a month, categorizing them into needs, wants, and savings. This process provides a clear picture of your financial health.

Once you have this information, analyze it to identify areas for improvement. Are unnecessary subscriptions eating away at your budget? Is there overspending on dining out or entertainment? Awareness of these patterns is crucial for making adjustments. This step also helps set the foundation for creating a realistic budget and identifying areas to allocate funds toward goals like saving, debt repayment, or investing.

Set Clear and Achievable Financial Goals

Financial goals give direction and purpose to money management efforts. Without goals, it’s easy to lose focus and fall back into old habits. Start by defining short-term goals, such as saving a specific amount or paying off a credit card balance. Long-term goals, like building a retirement fund or purchasing a home, should also be part of the plan. Each goal should be specific, measurable, and have a clear timeline for completion.

Having goals tied to personal motivations can make achieving them more rewarding. For example, the desire for financial independence or the dream of starting a business can drive consistency. Break down larger goals into smaller milestones to track progress and maintain momentum. Setting goals not only provides clarity but also keeps financial decisions aligned with future aspirations.

Build and Stick to a Realistic Budget

A budget is the cornerstone of financial success. It provides a roadmap for spending, saving, and investing while ensuring that income is used effectively. To create a realistic budget, start by allocating funds to essentials such as housing, utilities, and groceries. Next, prioritize savings and debt repayment, leaving a smaller portion for discretionary spending.

The key to sticking to a budget is flexibility and regular adjustments. Unexpected expenses or changes in income may require rebalancing. Using budgeting tools or apps can simplify the process and provide insights into spending habits. A well-maintained budget ensures financial goals remain on track and prevents overspending from derailing progress.

Eliminate Unnecessary Expenses

Cutting unnecessary expenses is one of the quickest ways to free up cash for more important priorities. Start by reviewing monthly bills and subscriptions. Are there unused streaming services, gym memberships, or premium plans that can be downgraded? Trimming these costs can save significant amounts over time.

Another area to examine is discretionary spending. Frequent dining out, impulsive shopping, or buying name-brand items can add up quickly. Opting for meal prepping, shopping sales, or choosing generic products are small changes that yield big savings. Eliminating or reducing unnecessary expenses allows for more resources to be directed toward financial goals like savings or investments.

Maximize Your Income Streams

Increasing income can accelerate financial progress and create opportunities for long-term stability. Diversifying income sources reduces reliance on a single paycheck and provides additional financial security. Consider picking up a side hustle, freelancing, or monetizing hobbies such as writing, graphic design, or tutoring. These extra earnings can be funneled directly into savings or investments.

For those employed full-time, negotiating a raise or seeking promotions can also make a significant difference. Building new skills or earning certifications in high-demand fields can lead to better job opportunities. Exploring multiple income streams is not only practical but also empowers individuals to take control of their financial future.

Attack Debt Strategically

Debt can be a major obstacle to financial freedom, but with a strategy, it can be conquered. Start by listing all debts, including credit cards, loans, and mortgages, along with their interest rates. Two popular repayment methods are the snowball and avalanche approaches. The snowball method focuses on paying off the smallest debts first to build momentum, while the avalanche method prioritizes debts with the highest interest rates for long-term savings.

Consistency is key in debt repayment. Setting up automatic payments or directing windfalls like bonuses or tax refunds toward debt can accelerate progress. Paying off debt not only reduces financial stress but also frees up income for other goals. A debt-free lifestyle provides a sense of freedom and allows for greater financial flexibility.

Build an Emergency Fund

An emergency fund is essential for weathering unexpected financial challenges. Having three to six months’ worth of living expenses set aside provides a safety net and reduces reliance on credit cards or loans in emergencies. Start small by saving a specific percentage of each paycheck, even if it’s only 5 or 10 percent.

Using windfalls such as bonuses or refunds to jumpstart an emergency fund can make reaching the target amount faster. Keeping this fund in a separate, easily accessible account ensures it is used only for true emergencies. An emergency fund offers peace of mind and prevents financial setbacks from derailing long-term goals.

Invest for Long-Term Growth

Investing is a powerful way to grow wealth and build financial security. While saving is important, investing allows money to work harder through compound growth. Explore options like stocks, index funds, and retirement accounts to find what aligns with risk tolerance and financial goals.

Starting early, even with small amounts, is beneficial since time in the market is more valuable than timing the market. Diversifying investments across different asset classes reduces risk and increases potential returns. Regular contributions and a long-term perspective are key to achieving financial growth and stability through investing.

Your Financial Freedom Starts Now

A year may feel like a short time, but with consistency and determination, it’s enough to transform finances significantly. By assessing the current situation, setting goals, eliminating wasteful spending, and creating additional income streams, anyone can build a solid financial foundation. These steps, paired with strategies like debt repayment, emergency savings, and investing, ensure lasting success.

Achieving financial freedom requires discipline, but the rewards—peace of mind, stability, and the ability to pursue dreams—are well worth the effort. Start today with small, intentional steps and commit to staying on course. In just one year, the transformation will be undeniable, and the future will be brighter than ever.