Cryptocurrency has rapidly transformed the landscape of financial transactions, introducing a digital economy that operates independently of traditional banking systems. Central to this digital economy are crypto wallets, essential tools for anyone engaging with cryptocurrencies. They not only facilitate the storage and management of digital assets but also ensure security in the decentralized world of digital currency. This guide delves into the fundamentals of crypto wallets, offering an essential understanding for both newcomers and seasoned users. It provides clarity on their operation, security, and the various types available, making it a crucial read for navigating the crypto space.

Contents

What are Crypto Wallets?

A crypto wallet is more than just a storage unit; it’s the gateway to interacting with the blockchain. These wallets don’t store physical coins; instead, they keep digital keys used to access cryptocurrency addresses and sign transactions. This distinction is crucial for understanding how digital currencies operate in a decentralized environment. There are various forms, including software, hardware, and paper wallets, each offering different levels of convenience and security.

The choice between a hot wallet (connected to the internet) and a cold wallet (offline storage) depends on the user’s needs for accessibility versus security. Hot wallets, like mobile or desktop applications, provide ease of access for daily transactions. In contrast, cold wallets, such as hardware or paper wallets, are best for long-term storage due to their reduced vulnerability to online threats. Each type caters to different aspects of cryptocurrency usage, from everyday spending to secure asset holding, making the understanding of their nuances vital.

How Do Crypto Wallets Work?

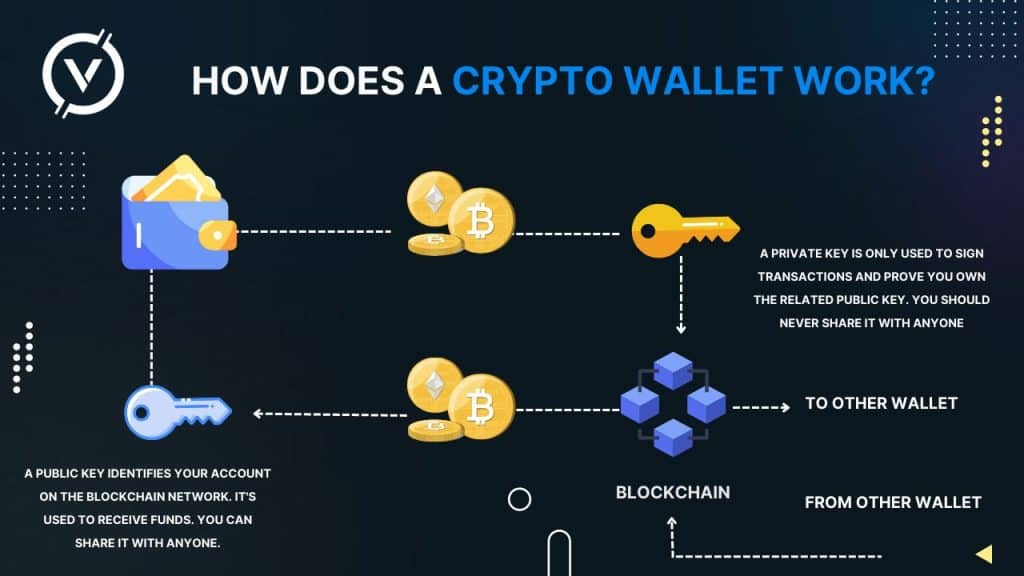

Crypto wallets operate using a pair of cryptographic keys: the public key and the private key. The public key can be shared and is used to receive funds, akin to a bank account number. The private key, however, should remain confidential, as it’s used to authorize transactions and access funds. This key pair is foundational to maintaining security and ownership in the blockchain network.

When a transaction is initiated, it’s signed with the sender’s private key and then verified by the network using the public key. This process ensures that only the rightful owner can spend the cryptocurrencies stored in a wallet. It’s a blend of simplicity and sophisticated cryptography, enabling secure and efficient transactions without the need for intermediaries. The decentralized nature of this system marks a significant shift from traditional financial models, emphasizing user autonomy and security.

Setting Up a Crypto Wallet

Choosing the right crypto wallet is a critical decision, hinging on factors such as the type of cryptocurrency, intended use, and the user’s approach to security. For beginners, software wallets provide a good balance of accessibility and security. However, for larger investments or long-term holding, hardware wallets offer enhanced security. Setting up a wallet typically involves downloading the software or purchasing the hardware device. For software wallets, the process includes creating an account and setting a strong password. Hardware wallets require initializing the device and setting a PIN.

Both types will generate a recovery phrase, which is paramount for accessing funds if the device is lost or the password is forgotten. The recovery phrase, usually a series of 12 or 24 words, acts as a backup key to the wallet. It’s essential to store this phrase securely and privately, as it’s the only way to regain access to the assets if the primary access method is compromised. This setup process underscores the responsibility that comes with managing digital assets, placing significant emphasis on security measures from the outset.

Security Measures for Crypto Wallets

The digital nature of cryptocurrencies makes them susceptible to various online threats, including hacking and phishing attacks. To counter these, adopting robust security measures is non-negotiable. This includes setting strong, unique passwords for wallet access and employing multi-factor authentication (MFA), which adds an additional layer of security beyond the password. Regular backups of the wallet, especially of the private keys and recovery phrases, are crucial. These backups should be stored in secure, offline locations to protect against online threats and physical damage.

Additionally, staying vigilant against phishing attempts, where malicious actors try to trick users into revealing their private keys, is essential. This means never sharing private keys or recovery phrases with anyone and verifying the authenticity of any communication claiming to be from wallet services or related entities. Using a dedicated device for cryptocurrency transactions can further enhance security. This isolates the wallet from everyday internet usage, reducing exposure to malware and hacking attempts. Regularly updating the wallet software is also important, as updates often include security enhancements and bug fixes. By combining these practices, users can significantly bolster the security of their crypto wallets, safeguarding their digital assets against a variety of threats.

Wallet Backup and Recovery

The backbone of a wallet’s security is its ability to be recovered if access is lost. This is where the recovery phrase, also known as a seed phrase, comes into play. Usually comprised of 12 or 24 words, this phrase is a representation of your wallet’s private keys. In the event of device failure, loss, or theft, this phrase is used to restore access to your funds on a new device or wallet software. It’s vital to keep this phrase written down and stored in multiple secure locations.

However, the responsibility of keeping a recovery phrase safe cannot be understated. If it’s lost or exposed to others, the consequences can be dire, including the irreversible loss of cryptocurrency assets. Advanced users might consider splitting their recovery phrase or using multi-signature wallets for additional security layers. Regardless of the method, understanding and implementing a robust backup and recovery strategy is essential for any crypto wallet user, ensuring long-term access and control over their digital assets.

Transferring and Receiving Funds

Transferring funds using a crypto wallet is a straightforward process but requires attention to detail to ensure the transaction is secure and accurate. To send cryptocurrency, users need the recipient’s public address, which functions like an account number. After entering this address and the amount to be sent, the wallet will typically display the transaction’s total cost, including any network fees. Once confirmed, the transaction is signed with the user’s private key and broadcast to the network for validation and completion.

Receiving funds is a matter of providing your public address to the sender. Most wallets generate a unique address for each transaction to enhance privacy and security. It’s crucial to ensure that the address is copied correctly, as transactions on the blockchain are irreversible. Once the funds are sent, they will appear in the recipient’s wallet after the transaction is confirmed by the network, which may take from a few seconds to several minutes, depending on the cryptocurrency and network congestion.

Advanced Features of Crypto Wallets

Beyond the basic functions of storing and transferring funds, many crypto wallets offer advanced features that cater to specific needs and enhance user experience. Multi-signature wallets, for example, require multiple approvals before a transaction can be made, adding an extra layer of security. This is particularly useful for businesses or organizations where funds’ movement should be a collective decision. Some wallets also offer built-in exchanges, allowing users to trade cryptocurrencies directly within the app, streamlining the process and sometimes offering more favorable rates.

Integration with decentralized finance (DeFi) platforms is another advanced feature gaining popularity. These integrations allow users to directly participate in lending, borrowing, or yield farming activities through their wallets. Furthermore, some wallets provide financial services like earning interest on your cryptocurrency or obtaining loans against it. As the crypto ecosystem evolves, wallets are increasingly becoming a central hub for managing not just assets but also engaging with a broader range of financial services and applications.

In understanding the dynamics of crypto wallets, from their basic functionality to advanced features, one becomes equipped to navigate the digital currency landscape with confidence. This guide has illuminated the importance of security, the nuances of wallet types, and the forward-looking innovations shaping their future. As the crypto world continues to evolve, staying informed and vigilant is key. Now is the time to step into the realm of cryptocurrencies, armed with knowledge and ready to secure and manage your digital assets effectively.