The barrage of terminology and jargon can be overwhelming in the complex investment world, especially for novice investors. This article aims to break down the most common financial terms and concepts, providing a clear understanding that empowers readers to make informed decisions. The investment journey becomes less daunting by demystifying terms like stocks, bonds, mutual funds, and more. The essence of this guide is to offer foundational knowledge that enhances financial literacy, encouraging a proactive approach to personal finance and investment strategy.

Contents

The Basics of Investment Terminology

At its core, investing involves allocating resources with the expectation of generating a profit or income. A cornerstone of investment is the stock market, where publicly traded company shares are bought and sold. Stocks represent a fraction of ownership in a company, offering potential growth through appreciation and dividends. Conversely, bonds are loans investors give to entities like corporations or governments in exchange for regular interest payments and the return of the bond’s face value at maturity. Mutual funds aggregate money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities financial professionals manage.

Understanding these basic instruments is vital for anyone entering the investment world. With their potential for high returns, stocks carry a greater risk of loss. Bonds offer more stability and predictable income, making them safer for risk-averse individuals. Mutual funds provide a middle ground, offering diversification and professional management, which can mitigate risk while allowing growth. These options should align with an investor’s financial goals, risk tolerance, and investment horizon.

The stock market is often seen as a barometer of economic health, reflecting the performance of companies and, by extension, the economy. Indices like the Dow Jones Industrial Average, S&P 500, and NASDAQ Composite provide snapshots of market trends, helping investors gauge overall market sentiment. A rising index suggests investor confidence and economic growth, while a declining index may indicate economic concerns or pessimism among investors.

Market sentiment, influenced by economic data, corporate earnings, and global events, drives short-term stock price movements. Understanding this sentiment is crucial for investors looking to buy or sell stocks. Positive news can lead to price surges, while negative news can trigger sell-offs. However, investors must look beyond short-term volatility and focus on long-term trends and fundamentals. This approach requires patience and a strong belief in the inherent value of their investments.

The World of Bonds Explained

Bonds, often considered the safer counterpart to stocks, play a crucial role in a diversified investment portfolio. Government bonds issued by national governments are deemed low-risk, backed by the issuing country’s ability to tax its citizens. Municipal bonds, offered by states, cities, or other local entities, often provide tax-free interest income, making them attractive to investors in higher tax brackets. Corporate bonds issued by companies tend to offer higher yields but come with an increased risk of default.

The concepts of yield and maturity are central to understanding bonds. Yield is the income return on an investment, expressed as a percentage, while maturity denotes the time the bond will repay its principal value. Interest rates directly impact bond prices and yields; bond prices typically fall as rates rise, and vice versa. Bond investors must be mindful of interest rate trends, credit, and inflation risks, balancing these factors against their investment goals and time horizons.

Deciphering Mutual Funds and ETFs

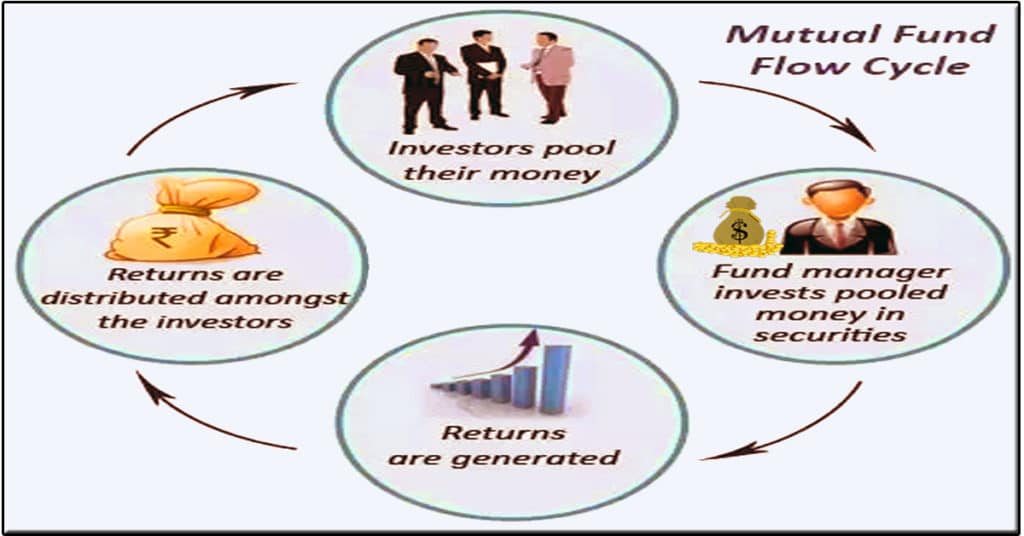

Mutual funds and Exchange-Traded Funds (ETFs) have democratized access to diversified portfolios. A mutual fund pools money from many investors to buy a wide range of securities managed by professional fund managers who make decisions on behalf of the fund’s investors. This management and diversification come at a cost, reflected in the fund’s expense ratio. Despite the fees, mutual funds remain popular for their simplicity and the ease with which investors can achieve a diversified portfolio.

ETFs offer a similar benefit to mutual funds but with a key difference: they are traded on stock exchanges like individual stocks. This gives ETFs greater liquidity and often lower fees than mutual funds, making them an attractive option for cost-conscious investors. Furthermore, ETFs cover various asset classes and sectors, allowing investors to tailor their exposure according to their investment preferences and risk tolerance.

Investment Strategies for Beginners

Choosing the right investment strategy is as crucial as understanding the instruments available. Passive investing, exemplified by index funds and most ETFs, involves mimicking the performance of a market index and benefits from lower fees and the historical upward trend of the markets over the long term. It’s based on the premise that it’s difficult to outperform the market consistently through active selection. Conversely, active investing requires a hands-on approach, with the investor or their fund manager making specific bets on stocks and sectors or timing the market to outperform a benchmark index. This approach can offer higher returns but comes with higher costs and risks, making it less suitable for novice investors without the time or expertise to closely monitor their investments.

Asset allocation is another critical concept, referring to how an investment portfolio is divided across various asset classes, such as stocks, bonds, and cash. The right allocation depends on an individual’s risk tolerance, investment horizon, and financial goals. A young investor with a long time horizon and higher risk tolerance might lean heavily towards stocks for growth, while someone closer to retirement may prefer bonds for income and stability. Regular rebalancing ensures the portfolio stays aligned with one’s investment strategy and risk profile, adapting to market conditions and personal circumstances changes.

Every investment carries risks, but understanding and managing these risks is key to successful investing. Market risk, or the risk of investment value falling due to economic developments, affects all securities to some extent. Credit risk involves the possibility of a bond issuer defaulting on its obligations, impacting bonds more directly. Inflation risk, or the erosion of investment purchasing power over time, is a concern for all investors, particularly those in fixed-income securities.

While risks are inherent, they are not without countermeasures. Diversification, spreading investments across various asset classes and sectors, can mitigate individual investment risks. Additionally, understanding how to measure returns through metrics such as ROI (Return on Investment) and comparing these on a risk-adjusted basis helps investors make informed decisions. Tools like the Sharpe ratio allow investors to compare the performance of different investments relative to their risk, enabling a more nuanced approach to portfolio construction.

The Importance of Financial Planning

Setting clear, realistic investment goals is the cornerstone of successful financial planning. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Whether saving for retirement, a child’s education, or a major purchase, having defined objectives guides the investment strategy and choice of instruments.

A comprehensive financial plan goes beyond just investing; it encompasses budgeting, emergency savings, insurance, and estate planning. This plan should be a living document, revisited and adjusted as personal circumstances and financial markets evolve. Regular reviews help identify whether you’re on track to meet your financial goals or if adjustments are needed, ensuring that investment decisions remain aligned with your long-term objectives.

The Bottom Line

Decoding the language of finance and investment is not just about understanding terms and concepts; it’s about gaining the confidence to make decisions that align with your financial goals. The journey through financial jargon to clear, actionable knowledge is crucial for anyone looking to navigate the investment landscape effectively. Financial success becomes a possible and reachable goal by starting with the basics, gradually expanding your understanding, and applying this knowledge through a well-considered investment strategy. Remember, the investment world is vast and continuously evolving, and ongoing education and adaptability are your best tools for long-term success.