Budgeting is a cornerstone of good financial health, personally and in the business world. One method that has gained traction for its thorough approach is zero-based budgeting. Unlike traditional budgeting methods that adjust previous budgets, zero-based budgeting starts from scratch – hence, the ‘zero’ base. This method is about cutting costs and encouraging individuals and organizations to justify every dollar spent. This piece will delve into the intricacies of zero-based budgeting, its advantages and drawbacks, its applicability in personal and business finance, and how to implement it.

Contents

- What Is Zero-Based Budgeting?

- The Mechanics Of Zero-Based Budgeting

- Pros Of Zero-Based Budgeting

- Cons Of Zero-Based Budgeting

- Zero-Based Budgeting In Personal Finance

- Zero-Based Budgeting In Business

- Tools And Resources For Zero-Based Budgeting

- How To Transition To Zero-Based Budgeting

- The Bottom Line

What Is Zero-Based Budgeting?

Zero-based budgeting is a method that requires every expense to be justified in each new period, starting from a “zero base.” This approach analyzes all functions within an organization or personal budget for their needs and costs. This contrasts traditional budgeting, which adjusts the previous budget to account for inflation or revenue growth. Instead of making assumptions based on past expenditures, zero-based budgeting operates on the assumption that no costs are immune to being cut.

Zero-based budgeting first rose to prominence in the 1970s, initiated by then-president Jimmy Carter’s administration. Although initially adopted by government bodies, the concept has favored many businesses and individuals. Zero-based budgeting primarily aims to lower costs by avoiding unnecessary spending, fostering a cost-conscious culture, and allocating resources efficiently.

The Mechanics Of Zero-Based Budgeting

Creating a zero-based budget requires a detailed and rigorous process. It starts with a complete breakdown of income and expenses, justifying each expenditure line by line. Every element is accounted for, from major costs like rent or salaries to minor ones such as stationery or snacks. This granular approach allows for a clear understanding of where money is going, thus fostering more mindful spending habits.

Zero-based budgeting also requires a degree of forecasting. Predicting future income and costs accurately is important as it can influence the budget’s validity and effectiveness. For instance, underestimating expenses or overestimating income can result in a shortfall, while the opposite may result in excessive frugality. Therefore, a zero-based budget is an exercise in meticulous accounting and careful prediction.

Pros Of Zero-Based Budgeting

The benefits of zero-based budgeting are numerous. One of the most noteworthy advantages is the control it provides over finances. By scrutinizing each expense, it helps prevent wasteful spending. It encourages a thoughtful approach to expenditure, ensuring each dollar spent brings value. This, in turn, promotes financial responsibility and consciousness, creating a culture of cost-efficiency, whether in personal finance or within an organization.

Zero-based budgeting can also lead to better decision-making. When every expense must be justified, it becomes clear which costs are necessary and which are not. This process can highlight areas of overspending or identify investment opportunities previously overlooked. It can also reveal expenditure patterns, leading to more informed financial planning. Thus, zero-based budgeting can be a valuable tool for individuals and organizations aiming to optimize their financial management.

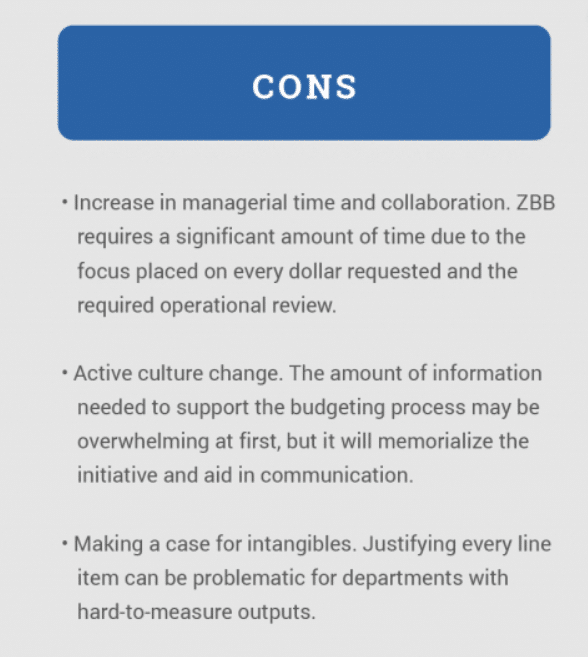

Cons Of Zero-Based Budgeting

While zero-based budgeting has its benefits, it is not without its drawbacks. The most significant disadvantage is that it can be time-consuming. As each expense must be justified from scratch, it can lead to a heavy administrative burden. This is especially true for large organizations with multiple cost centers, but even individuals may find the process daunting compared to traditional budgeting methods.

Unpredictable expenses can also pose a challenge. Despite the best efforts to forecast, there will always be unexpected costs, from sudden vehicle repairs for individuals to emergency equipment replacements for businesses. While it’s possible to have a contingency fund, zero-based budgeting’s strict approach can make it difficult to manage these unforeseen expenditures. Furthermore, strict adherence to a zero-based budget may also pose a psychological challenge as it requires high discipline and commitment to stick to the budget.

Zero-Based Budgeting In Personal Finance

Zero-based budgeting isn’t just for businesses; it can also be successfully implemented in personal finance. Justifying every expense can provide a powerful insight into one’s spending habits and potential areas of wastage. For instance, a detailed look at monthly subscriptions may reveal that some services are rarely used and can be eliminated.

There are numerous examples of individuals achieving financial success through zero-based budgeting. This method can be especially beneficial for those working towards a specific financial goal, such as paying off debt or saving for a significant purchase. By ensuring every dollar is assigned a task, progress towards these goals can be tracked and accomplished. Consistency and commitment to the process are the keys to personal success with zero-based budgeting.

Zero-Based Budgeting In Business

At the corporate level, zero-based budgeting can be transformative. It encourages businesses to evaluate the cost and value of every function, leading to more efficient resource allocation. This approach can reveal opportunities for cost-saving that a traditional budget might overlook. However, implementation in a business context has challenges, including resistance from employees accustomed to traditional budgeting methods.

Yet, several companies have successfully integrated zero-based budgeting into their financial operations. For example, businesses in the fast-moving consumer goods sector have adopted this approach to combat thinning margins and increased competition. By re-evaluating every aspect of their operations, these companies have identified efficiencies and improved their bottom line, proving that with the right application, zero-based budgeting can deliver significant results in the corporate world.

Tools And Resources For Zero-Based Budgeting

Numerous digital tools and applications are available to aid in the implementation of zero-based budgeting. These can automate parts of the budgeting process, track income and expenses, and even provide reminders about budget limits. Some popular ones include personal finance apps like Mint and You Need a Budget, which can be customized for zero-based budgeting.

Despite their convenience, these tools aren’t without their limitations. Some may not have the flexibility to cater to unique budgeting requirements, while others might lack robust reporting features. However, the digitization of zero-based budgeting has generally made the method more accessible and less time-consuming, facilitating its adoption by individuals and businesses alike.

How To Transition To Zero-Based Budgeting

Switching to zero-based budgeting from a traditional budgeting method can be a significant adjustment. It requires a fundamental shift in the approach to budgeting, which may initially seem overwhelming. However, breaking the process into manageable steps can make the transition easier. Start by familiarizing yourself with the method and understanding its principles and requirements.

One of the primary obstacles when transitioning is the effort and time required to justify every expense. But, over time, as one becomes more acquainted with the process, this becomes less of a burden. It’s also essential to anticipate potential resistance, especially in business. Changing a familiar process can often face opposition, but clear communication about the benefits and training can help overcome this resistance. With patience and perseverance, the transition to zero-based budgeting can lead to more efficient and insightful financial management.

The Bottom Line

The journey through zero-based budgeting reveals a method that offers detailed control over personal and corporate finances. While it may present challenges, such as time consumption and difficulty managing unexpected expenses, the benefits often outweigh these drawbacks. From increased financial awareness to more efficient resource allocation, zero-based budgeting encourages a comprehensive expenditure review, fostering more informed decision-making.

Transitioning to zero-based budgeting is a considerable shift for personal finance or business management. Yet, the transition is manageable with the right tools and a gradual, thoughtful approach. As with any financial strategy, the key is to assess whether zero-based budgeting aligns with individual or organizational goals. In the complex financial management landscape, selecting the right budgeting method can make a significant difference. Zero-based budgeting is undoubtedly a compelling option to consider.