Financial decisions are integral to our lives, affecting everything from our day-to-day well-being to our long-term goals and security. While it’s easy to think these choices are made purely on rational calculations, the reality is far more complex. Psychological factors often play a significant role, subtly influencing our judgments and actions in ways we may not know. Understanding these psychological traps can help us make more informed and rational financial decisions. This article explores some of the most common psychological pitfalls that can adversely affect your financial choices, from emotional spending to the fear of missing out.

Contents

The Role of Emotions in Financial Decisions

Emotions wield a powerful influence over our financial decisions, often in counterproductive ways. For instance, stress or happiness can trigger impulsive spending as a form of emotional relief or celebration. As it is colloquially known, retail therapy may provide temporary satisfaction but often leads to long-term financial strain. Similarly, emotions like fear or excitement can drive investment choices, causing individuals to buy high out of enthusiasm and sell low out of panic, a surefire way to incur losses.

It’s crucial to develop self-awareness and emotional regulation skills to mitigate the impact of emotions on financial decisions. Strategies such as taking a step back to assess the situation objectively, consulting with a financial advisor, or even waiting a predetermined period before making a significant financial move can help. One can make more rational and beneficial financial decisions by recognizing the emotional triggers and implementing these strategies.

The Sunk Cost Fallacy

The sunk cost fallacy is another psychological trap that can severely impact financial decisions. This fallacy occurs when individuals continue to invest time, money, or resources into something based solely on the amount already invested rather than evaluating the current and future value of the investment. For example, someone might continue to pour money into a failing business simply because they’ve already invested so much, ignoring the bleak prospects.

Overcoming the sunk cost fallacy requires a shift in mindset. It’s essential to view each decision as independent of previous investments. This can be challenging, as it often means admitting a mistake or losing what was already invested. However, focusing on the potential future returns and detaching from past costs can make more rational and profitable decisions.

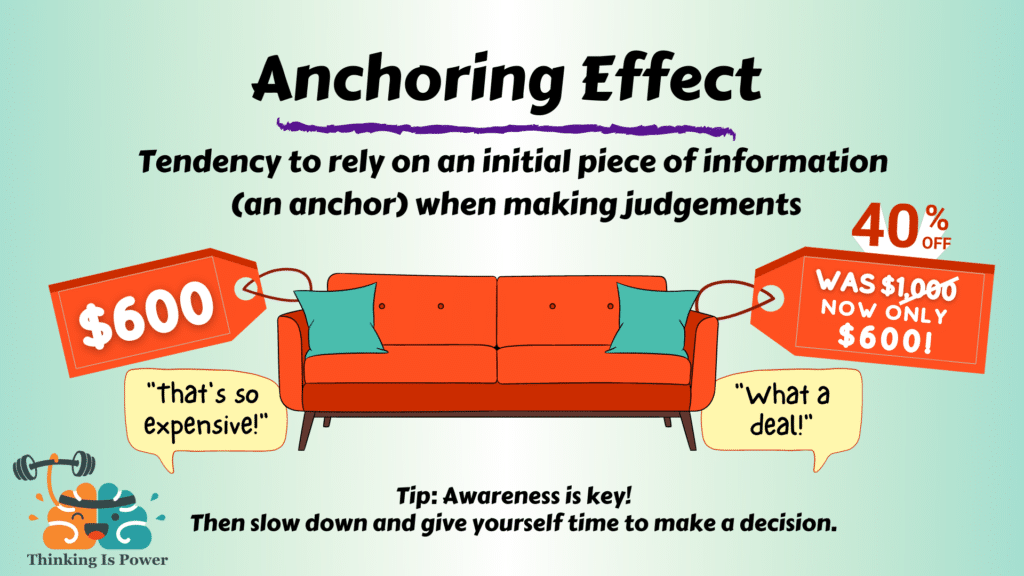

The Anchoring Effect

Anchoring is a cognitive bias where an individual depends too heavily on an initial piece of information, known as the “anchor,” to make subsequent decisions. In the financial realm, this can manifest in various ways, such as accepting the first salary offer received without negotiation or being influenced by the initial price of a stock or a car. The anchor sets a reference point that can skew perception and decision-making, often to one’s financial detriment.

Breaking free from the anchoring effect involves doing independent research and being aware of the bias. Before making a significant financial decision, gathering information from multiple sources and considering a range of options is advisable. This helps to recalibrate the anchor and allows for a more balanced and informed decision. Awareness of the anchoring effect is the first step towards mitigating its impact on financial choices.

Overconfidence and Financial Decisions

Overconfidence can be a significant hindrance in making sound financial decisions. Many people overestimate their abilities, knowledge, or skill level, leading them to take unnecessary risks. This is particularly evident in investments, where overconfidence can lead to excessive trading, risk-taking, and financial loss. The belief that one can outperform the market or has some unique insight can be detrimental.

The Dunning-Kruger effect, a cognitive bias where people with low ability at a task overestimate their ability, can exacerbate this issue. In financial decisions, this means that the least competent individuals are also the least aware of their incompetence, leading to a cycle of poor decisions and financial setbacks. To counteract overconfidence, it’s essential to seek external opinions, continually educate oneself, and be willing to reassess one’s strategies and approaches regularly.

The Fear of Missing Out (FOMO)

The Fear of Missing Out, commonly known as FOMO, is a pervasive psychological phenomenon that can significantly impact financial decisions. Social media platforms amplify this fear by showcasing others’ investment successes or lifestyle upgrades, creating a sense of urgency and inadequacy. This can result in impulsive decisions, such as jumping on investment trends without adequate research or making large purchases to keep up with perceived social standards.

The financial repercussions of FOMO-driven decisions can be severe, including debt accumulation and investment losses. To counteract FOMO, developing a strong sense of individual financial goals and priorities is crucial. Instead of being swayed by external influences, focus on what is genuinely important for your financial well-being. Setting long-term objectives and sticking to a well-thought-out financial plan can help mitigate the effects of FOMO.

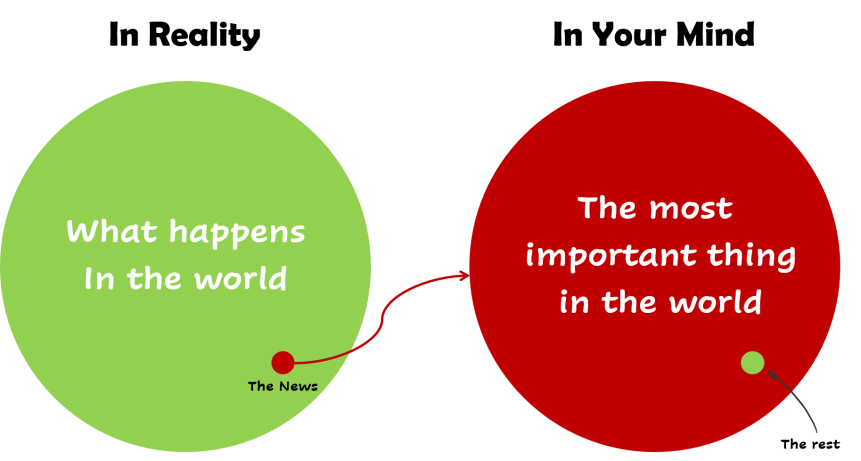

The Availability Heuristic

The availability heuristic is a mental shortcut that relies on immediate examples that come to mind when evaluating a specific topic or decision. This can lead to poor decisions based on recent events or experiences in financial contexts. For example, suppose someone hears about a friend’s successful investment in cryptocurrency. In that case, they might be inclined to invest heavily in it themselves, ignoring the risks and volatility associated with such assets.

Mitigating the availability heuristic involves seeking diverse information sources and taking a more comprehensive view of the situation. Before making any significant financial decisions, it’s advisable to consult various sources of information, including historical data and expert opinions. This broader perspective can help individuals make more informed and rational financial choices, reducing the influence of recent events or anecdotal experiences.

The Confirmation Bias

Confirmation bias is the tendency to search for, interpret, and remember information in a way that confirms one’s preexisting beliefs or values. In financial decisions, this can lead to ignoring red flags or failing to consider alternative options, resulting in poor financial outcomes. For instance, an investor might only read articles that confirm their positive view of a particular stock, ignoring any negative news or indicators.

Overcoming confirmation bias requires a conscious effort to challenge one’s own beliefs and seek out differing opinions. Before making a financial decision, it’s beneficial to consult various sources and viewpoints. Being open to contradictory information provides a more balanced view and prepares one for various potential outcomes, making for more robust financial planning.

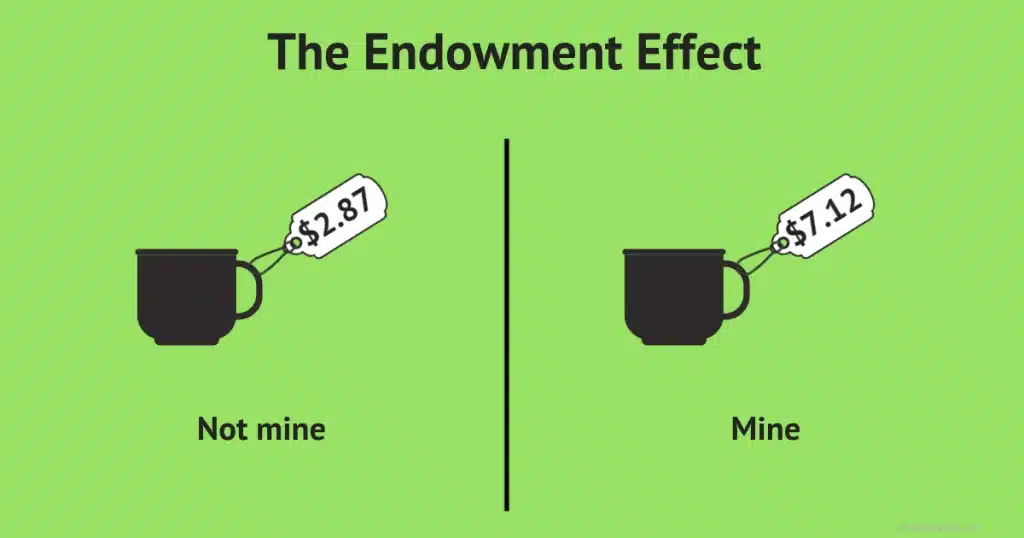

The Endowment Effect

The endowment effect is a cognitive bias that makes people overvalue what they own, affecting decisions about selling assets or possessions. For example, a homeowner might set an unrealistically high selling price for their property simply because they have emotional attachments or have invested in home improvements.

One can view possessions and investments from an outsider’s perspective to counteract the endowment effect. Consulting third-party valuations and considering the market conditions can provide a more objective basis for decision-making. It’s also helpful to separate emotional attachment from the actual value of an asset, allowing for more rational financial choices.

The Bottom Line

Understanding the psychological traps influencing financial decisions is crucial for long-term financial well-being. From the role of emotions to various cognitive biases like the sunk cost fallacy, anchoring effect, and overconfidence, being aware of these pitfalls can significantly impact the quality of financial choices one makes. The first step in mitigating these effects is awareness, followed by active strategies to counteract them. By taking a more informed and rational approach, individuals can successfully navigate the complex world of financial decision-making, ensuring a more secure and prosperous future.